Fixed Income Market Update

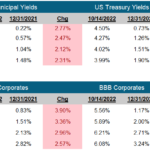

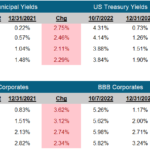

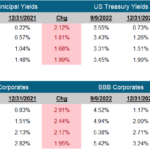

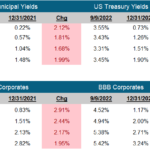

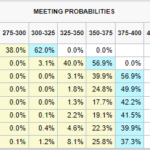

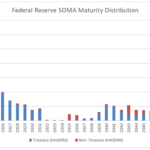

October 28, 2022 The fixed income markets are abuzz with the potential of a Fed Pivot, or the idea the Fed might change from hiking to pausing to cutting. We say, will the Fed just relent? The Fed, focusing on not repeating the mistakes of the 70’s, is quickly raising rates to a