Objective and Approach

The Enhanced Income Municipal strategy is a boutique fixed income solutions that invests in callable municipal bonds with higher than typical yields due to the markets inability to assess the likelihood of a call event.

Led by 40-year industry veteran, Jud Hennessy, the Genoa team has in-depth knowledge of the municipal bond market. The team evaluates each bond and its issuer and purchases only bonds they believe are less likely to be called.

This approach gives Enhanced Income Municipal the potential to enhance income without sacrificing credit quality or increasing market risk (duration).

| Portfolio Rating: | AA |

| Average Duration: | < 1 Year |

| Number of Holdings: | 18-24 |

| Target Net Investment Yield: | 3% to 4% |

Investment Example

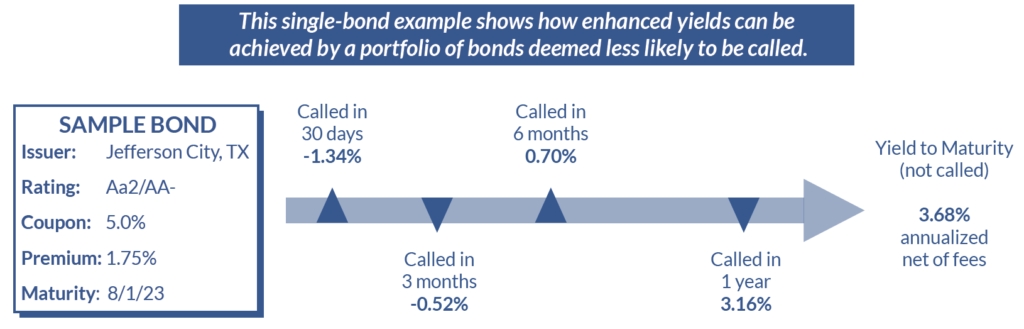

Some municipal bonds may be mispriced due to the market’s inability to efficiently asses the risk of the bond being called.

Successful execution requires analysis of multiple factors affecting the likelihood of a call. This analysis must be performed for each individual bond and issuer.

Limited market size and detailed analysis requirements make this a unique opportunity for a boutique investment firm like Genoa to construct and manage portfolios for investors seeking enhanced income.

Successful execution requires analysis of multiple factors affecting the likelihood of a call. This analysis must be performed for each individual bond and issuer.