Objective and Approach

Bond ladders are a time-tested strategy. A laddered bond portfolio consists of bonds with varying maturities. As holdings mature, the proceeds may be reinvested into new bonds, or redeployed for your personal or investment needs.

By owning bonds with different maturity dates—the rungs of the ladder—and reinvesting in longer-term bonds as each bond matures, you can manage your income stream and risks over time, as well as adjust to changing market conditions, interest rates, and personal requirements.

How Genoa Enhances the Bond Ladder

At Genoa, we seek to enhance our bond ladder portfolios.

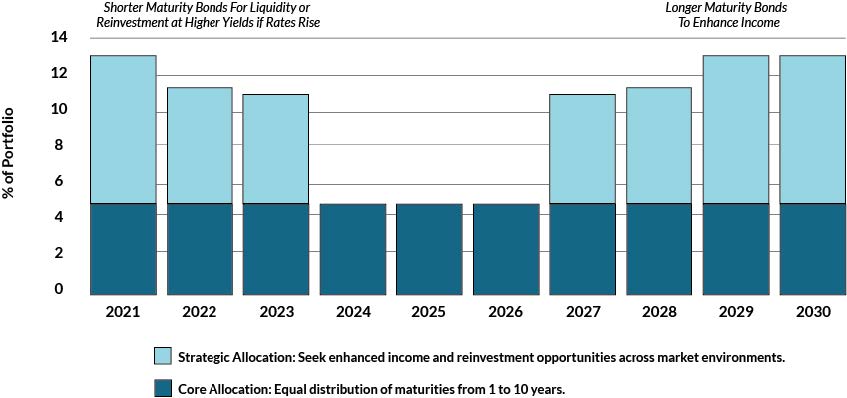

First, we allocate the core of the portfolio to a ladder of high-quality bonds with one to ten-year maturities, each bond carefully selected based on our proprietary research.

Then, we dynamically deploy portions of the portfolio to both:

- Shorter maturities—to reduce interest-rate risk and capture higher yields if rates rise

- Longer maturities—to enhance income

Over time, we will adjust the allocations to shorter and longer maturities to complement the core bond ladder as interest rates and fixed income markets evolve.

At Genoa, we believe we can enhance the traditional bond ladder by adding these additional allocations to shorter-term and longer-term bonds—providing the flexibility to capture income opportunities as interest rates change across market cycles. Genoa Enhanced Bond Ladders may utilize taxable or tax-exempt bonds, or a combination of both.

How we Enhance the Bond Ladder

if rates rise, and by adding longer-maturity bonds to enhance income.

Flexible Allocation

Based on Investor state of residence:

| National | Seek diversification, yield and appreciation for investors with no state income tax obligations |

| State Preference | Focused approach seeking enhanced after-tax yields for clients in high tax states such as California and New York |