Get the latest Insights and News from Genoa Asset Management.

Articles & Updates

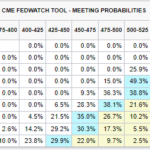

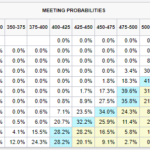

- Rates have Peaked!November 3, 2023 Okay, maybe we are early (Maybe we are wrong and rates will never be this low again!) but this has been a powerful rally in the long end of the curve. Since October, the 10-year yield had risen 41 basis points to a high of 4.99% and then,

- Fixed Income Market UpdateOctober 20, 2023 Since the July 26th meeting (The last time the Fed raised the Overnight rate to 5.25-5.50%), the yield on the US Treasury 30-year Bond has risen 1.13%. Other longer dated bonds have followed suit and their yields have climbed. As the yields have climbed, their prices have fallen, creating

- Fixed Income Market UpdateOctober 6, 2023 History doesn’t always repeat, sometimes it doesn’t even rhyme. Take 2023 for instance, just about everyone in the market has been calling for a recession. Since 2021 when the Fed started raising interest rates the theme was not “If” but “When” the recession would start and how bad

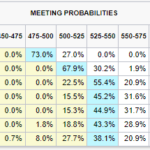

- Fixed Income Market UpdateSeptember 15, 2023 Okay so the 1974 PR effort by President Ford was considered to be one of the biggest government public relations blunders ever, but perhaps it has application now? As the FOMC gathers next week to decide whether to raise, pause or hold; we say: Whip Inflation Now! This

- Fixed Income Market UpdateAugust 18, 2023 It’s Jackson Hole week, the annual Fed symposium that ends with a speech from Fed Chair Powell. Since the last FOMC meeting, July 26th, the 10-year yield has risen 39 basis points and the 2-year yield has risen 8 basis points, causing the yield curve to bear steepen. Add

- Fixed Income Market UpdateAugust 4, 2023 The consensus is in, we are heading for a soft landing. But someone forgot to tell the bond market. If we are heading for a soft landing, aka All Set no recession, how does the currently inverted curve, un-invert? Typically, long US Treasury rates are higher than short

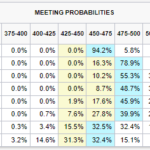

- Fixed Income Market UpdateJuly 28, 2023 A dovish Fed meeting, a solid GDP report and an encouraging PCE report all supported the soft-landing scenario. However, fixed income markets responded negatively as investors realized just how long rates may stay high and what that might mean for the curve. Wednesday the FOMC raised the

- Fixed Income Market UpdateJuly 14, 2023 The recent CPI and PPI reports increased the potential for a soft landing for the US Economy. This is good news, job losses, company defaults and market turmoil should be avoided, if it’s possible. But the FOMC remains steadfast in their determination to fight the inflation they see in

- Peter Baden Provides His Market Perspectives on Trader TVGenoa Asset Management’s own Peter Baden joined Trader TV this week to discuss why to focus on chemicals in European trading, opportunities in Gilts, and what US Treasuries are showing investors after last week. Jump to the 2:40-minute mark for his commentary. Please stay up to date on our latest news and

- Fixed Income Market UpdateJune 30, 2023 Markets moved aggressively this week. Positive revisions to first quarter GDP cleared the deck for the additional FOMC overnight rate increases that Fed speakers were signaling in their speeches. But is the economy really growing that fast, today? Friday’s release of the PCE report and earnings guidance from key industries

- Fixed Income Market UpdateJune 22, 2023 The FOMC held their meeting last week. From that we have a press release, press conference various speeches and congressional testimony. The overriding theme has been: Higher rates for longer (Note, we are back to Higher). But didn’t the FOMC just pause? If they are so worried to get inflation down

- Fixed Income Market UpdateJune 9, 2023 The great funding has started. The US Treasury is rebuilding the Treasury General Account (TGA, The checking account at the Fed) by some estimates as much as $1 trillion. So where is that money going to come from, what is the potential impact and are there any opportunities? This

- Fixed Income Market UpdateJun 2, 2023 After all the rhetoric, all the hand wringing and all the sound bites, the House and the Senate passed the debt ceiling suspension. Just a commentary on the voting: The final tally for the House vote was 314 to 117. The tally for the Senate vote was 63 to

- Fixed Income Market UpdateMay 8, 2023 We are changing things up this week. We issued a full analysis of the debt ceiling, how it came to be and potential outcomes. You can find it at: https://www.ustreasuryetf.com or Click Here to get the PDF directly. We continue to encourage advisors, clients and partners to

- Fixed Income Market UpdateApril 21, 2023 Markets have a lot to think about. There are concerns about inflation, interest rates, the economy and the market itself, to name a few. But, for the most part, we don’t fully control any of those things, we can affect them, but not control them. That’s why it’s frustrating that

- Fixed Income Market UpdateApril 14, 2023 This week, the Consumer Price Index and the Producer Price Index were released. The results were not bad. Unfortunately, they were not great. They showed there is still more work for the Fed to do before they can think about a Terminal Rate. The CPI ex-Food and Energy report showed some sectors with easing

- Fixed Income Market UpdateApril 7, 2023 Is inflation tamed? Are the banks going bust? Are we in for a hard landing? Those are the questions of the moment. After this week and next we should have more clarity. With the ISM, JOLTS, and Jobs reports we got some of the answers, with the CPI, PPI and Retail Sales

- Fixed Income Market UpdateMarch 31, 2023 Finally, the Fed’s historic rate increases have broken something in the economy (We did say they would, several times). You could almost hear the sigh of relief from Washington. A second sigh was heard after the markets calmed this week, and no more banks failed, here or in Europe. The

- Fixed Income Market UpdateMarch 17, 2023 The market was a rollercoaster the last ten days, in particular the last week. On March 8th the 2-Year US Treasury yield was at 5.07%. By the 13th the yield sank (prices rose) to 3.98%. The note then proceeded to swing by 15-30 bps each day this week! Banking industry revelations,

- Fixed Income Market UpdateMarch 13, 2023 Over the weekend, Silicon Value Bank (SIVB) and Signature Bank New York – SBNY were seized by regulators and First Republic Bank (FRC) taped additional liquidity. The Fed and the market listened to our post and took drastic action to stop the run on the banking system. This

- Fixed Income Market UpdateMarch 10, 2023 Yesterday SVB Financial (SVB) parent company of Silicon Valley Bank announced they are doing a significant capital raise to cover losses from their portfolio of… Mortgage backed and Treasury Bonds. SVB stock dropped 60%, bonds and preferred issues were down significantly and Moody’s announced a downgrade of the

- Fixed Income Market UpdateFebruary 24, 2023 Sometimes markets can be clear, and you can see direction for as far as the eye can see. Other times, the vision is hazy, cloudy, or even stormy. Uncertain times make us long for clarity. We regularly run through an exercise to identify the source of the uncertainty

- Fixed Income Market UpdateFebruary 17, 2023 Markets rarely ever move in a straight line. Neither does inflation or the economy. And that is what we found in the last couple of weeks. After the strong employment report (that many discounted), we had more reports on Retail Sales, the Consumer Price Index and the Producer Price Index. All of these important reports showed: a

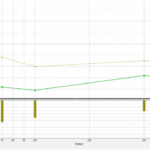

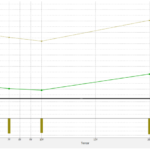

- Fixed Income Market UpdateJanuary 24, 2023 Take a look at the yield curve chart below. The gold line is the curve on October 24, 2022 (The day the yield on the 10-Year US Treasury hit its most recent high), the green line is January 18, 2023. Since that point in October, the curve has twisted

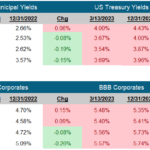

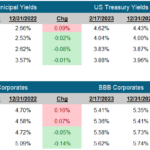

- Fixed Income Market UpdateJanuary 13, 2023 Investing in fixed income is all about hierarchy. At the top are US Treasuries. They are the safest, most liquid fixed income investments in the market. Every other fixed income security trades off where the corresponding US Treasury issue is trading. That is for good reason, if you can buy a

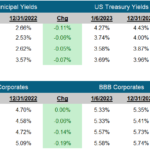

- Fixed Income Market UpdateJanuary 6, 2023 Fixed income ended 2022 on a negative note. With the October and November CPI prints showing disinflation, the markets anticipated a more dovish Fed. However, the Chairman was resolute, and bond markets dropped as yields rose. So where do we stand after improving inflation reads in Europe and the US?

- Fixed Income Market UpdateDecember 16, 2022 With another good CPI report in the hopper, the market continued the relief rally it started when the October CPI report was released. There was plenty of good news on the inflation front, month over month was only up 0.1% and Ex Food and Energy was up only

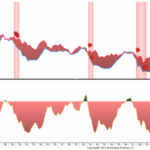

- Fixed Income Market UpdateDecember 9, 2022 The bond market can be a pretty good forecaster. Looking back over the last 50 years, it’s been very good at forecasting recessions. The track record? Seven for seven. And the crystal ball it uses to do this prediction? The yield curve, specifically an inversion of the yield curve. The

- Fixed Income Market UpdateDecember 2, 2022 Is the Fed finally Relenting? In a speech at the Brookings Institute, Chairman Powell laid out the Central Banks’ current thinking on the economy, rates and the path forward. In the speech, littered with caveats, the Chairman said what the market expected, and needed. The Fed is thinking of relenting. After

- Fixed Income Market UpdateNovember 4, 2022 Wednesday afternoon the Fed Statement came out and it seemed, reading between the lines, that perhaps the Fed was changing their tune (Dare we say, Relenting?). As the market breathed a sigh of relief, the press conference started, and we found out Chairman Powell and the Fed are