April 21, 2023

Markets have a lot to think about. There are concerns about inflation, interest rates, the economy and the market itself, to name a few. But, for the most part, we don’t fully control any of those things, we can affect them, but not control them. That’s why it’s frustrating that we have this manufactured crisis called the Debt Ceiling Crisis. It’s politician made, it serves no purpose and it sends shivers through bond raters, market makers and investors just as we approach the Terminal Overnight Fed Funds Rate and the drag on the economy is at its highest.

These fights over the Debt Ceiling are battles that should have been waged when the spending bills were proposed. The idea of a do-over through holding the country, financial markets and the American taxpayer hostage is destructive. Let’s just look at the 2011 Debt Crisis the United States got downgraded from AAA to AA+ by Standard and Poor’s. According to the CBO the cost of the 2011 Debt Crisis cost our country $1.3 BILLION in 2011 However, this does not account for the multiyear effects on increased costs for Treasury securities that will remain outstanding after fiscal year 2011. Ask yourself, was it worth it? Did the 2011 crisis change anything that was worth that much?

For those that don’t understand, the dollar and US Treasuries hold a central place in the world’s economy. Since Alexander Hamilton the US Government has met it’s obligations, on time, in full. That pledge has created a “Risk Free” asset that the value of every other asset is based on. All of banking, insurance, real estate, and every other corner of business, government, and life are affected by this risk-free rate. Did you notice the economic expansion of the last decade? A low-risk free rate (Aka. US Treasury yields), provided the foundation for all the new buildings, new companies, expansions, cheap mortgages and the profits that cycled back into the economy through increased salaries, bonuses and dividends. Those recycled profits are then invested in markets, improved quality of life, new opportunities, and philanthropy.

Timing of the crisis is a moving target, but we got an important piece of that puzzle this week when authorities started reporting lower than expected tax received. Suddenly expectations of a July-August default moved forward to an early June timeframe. We will get more information from Janet Yellen when they finish their projections.

So far, most areas of the market are sanguine about the 2023 crisis. History has shown it’s temporary and that eventually all sides come together. But the US Treasury Bill market is in turmoil. Thursday the yield on the 1-month Bill swung over 76 basis point (As high as 3.8% and as low as 3.04%) before closing the week at 3.2%. Bid-ask spreads on off-the-run Bills due in June, July and August are as wide as 13-14 basis points compared to off-the-run Bills due in September around 6 basis points. On-the-run Bill spreads are still tight but are quickly spreading as they roll off.

Frustrating as this is, we are carefully investing around the potential default dates, but also recognizing a short-term opportunity in the market if choose appropriate Bills and trade them well. But we are also encouraging advisors, clients and partners to reach out to their representatives. Lawmakers are not in our industry, they are not experts about the market and need to hear from constituents that are. Otherwise, they will continue to hear from their party base that may see this as a political win with a moderate cost. Contact your representatives (All of them). Here are some links to help:

- https://www.house.gov/representatives/find-your-representative

- https://www.senate.gov/senators/senators-contact.htm

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

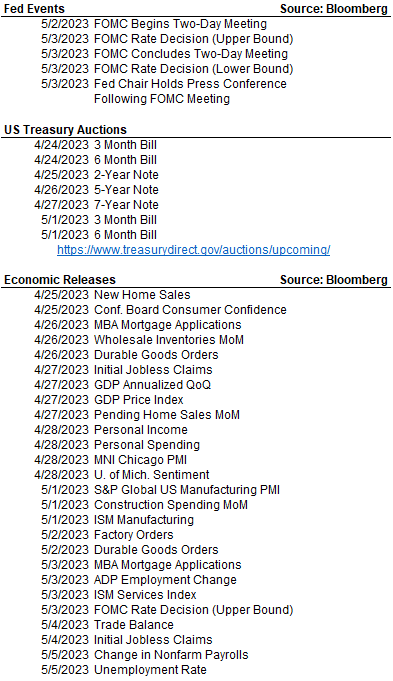

Next FOMC Decision

May 3, 2023

The Week Ahead

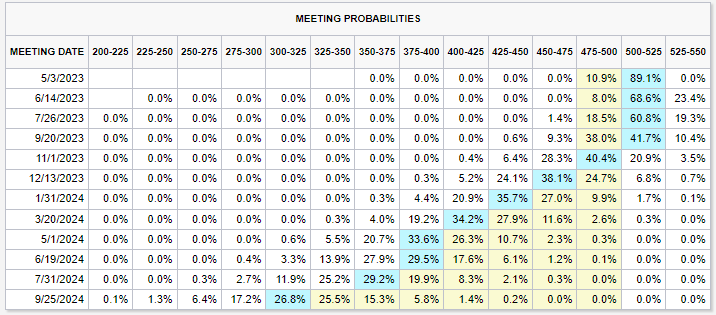

CME Fed Watch Tool

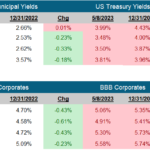

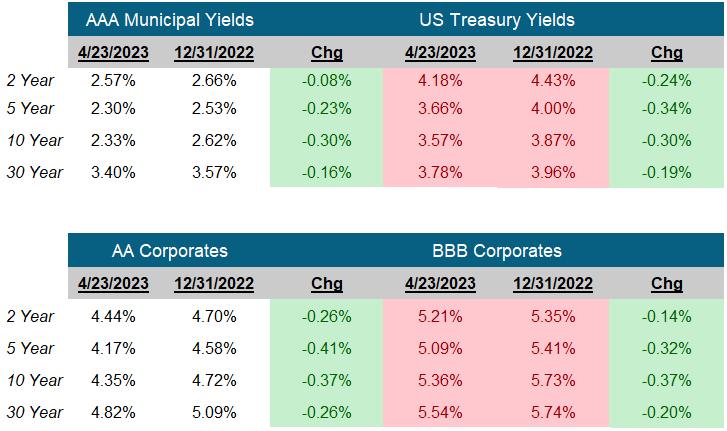

Fixed Income Rates

Click on the above links for more information on important investment and economic concepts.

Contact Genoa Asset Management

William (Kip) Weese

SVP, Intermediary Sales

Northeast & South West

(508) 423-2269

Email Kip

Rick Bell

VP, Intermediary Sales

North Central & North West

(513) 762-3694

Email Rick