Rates have Peaked!

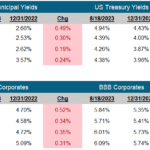

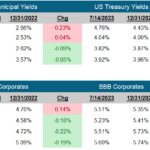

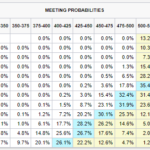

November 3, 2023 Okay, maybe we are early (Maybe we are wrong and rates will never be this low again!) but this has been a powerful rally in the long end of the curve. Since October, the 10-year yield had risen 41 basis points to a high of 4.99% and then,