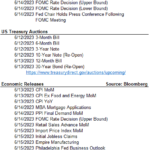

Fixed Income Market Update

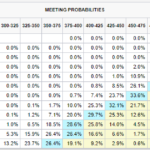

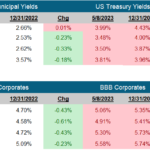

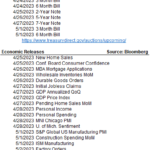

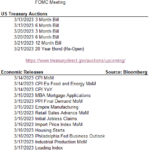

June 9, 2023 The great funding has started. The US Treasury is rebuilding the Treasury General Account (TGA, The checking account at the Fed) by some estimates as much as $1 trillion. So where is that money going to come from, what is the potential impact and are there any opportunities? This