Jun 2, 2023

After all the rhetoric, all the hand wringing and all the sound bites, the House and the Senate passed the debt ceiling suspension. Just a commentary on the voting: The final tally for the House vote was 314 to 117. The tally for the Senate vote was 63 to 36. This is how a democracy works, a compromise that the extremes of each party didn’t like, but the middle could vote for. Perhaps the media cover more of the middle rather than the extremes? It might make the government work a little better.

One last thought beware temporary suspensions. They are like temporary taxes. They have been known to evolve into permanence.

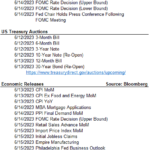

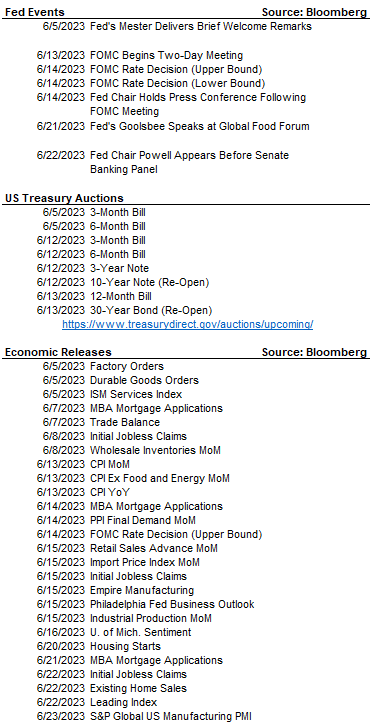

Now that the debt ceiling is behind us we have the Great Fundraising! The US Treasury bank account is empty, and they need to get it refilled. Some estimates are for $1 trillion over the next year, along with regular funding needs. While there are a lot of moving pieces to money markets, this level of capital raise might well put added stress on a market that is already challenging banks and other companies trying to raise capital.

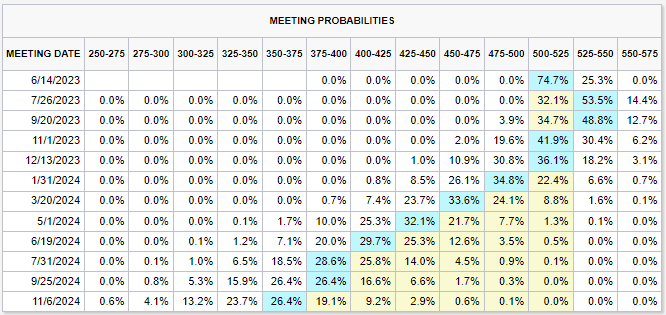

While we were all distracted, the job market got stronger. A whole lot stronger. On Friday, the Bureau of Labor Statistics released Non-Farm Payrolls up 339k jobs versus a Bloomberg consensus estimate of 195k jobs and April’s 294k jobs (revised up by 41k jobs). A stellar showing, but very concerning for inflation. This release continues a run of concerning inflation developments, leaving the Fed with a tough decision to make Jun 14th. If they pause, the futures market expects them to increase the Overnight Fed Funds Rate again in July. This would be the first pause and increase in the post-Volker Fed Era.

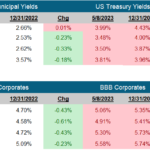

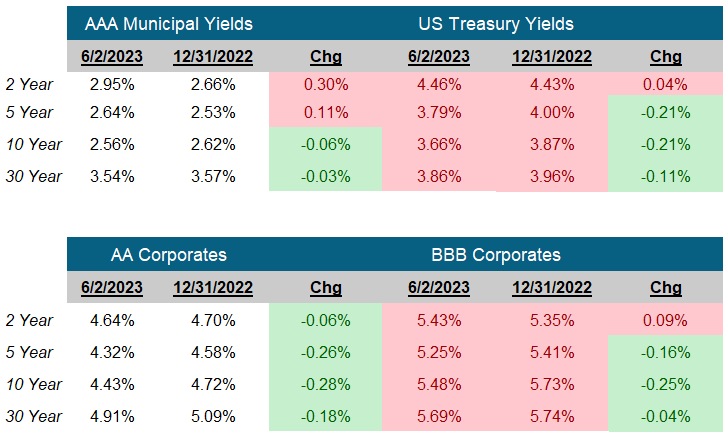

What to do? Building portfolios is all about balancing risk and reward. It’s tempting to favor the yield of a 3-Month US Treasury bill at a 5.32% or a 6-Month Bill at 5.40% or even a 12-Month Bill at 5.18%. But what if rates are much lower when that bill expires? We like to balance the Bills by adding duration to our portfolios with the 10-Year Note at 3.66%. That locks in today’s rate and, With an active Fed aiming to lower inflation, potentially profit from lower long-term rates.

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

Next FOMC Decision

June 14, 2023

The Week Ahead

CME Fed Watch Tool

Fixed Income Rates

Click on the above links for more information on important investment and economic concepts.

Contact Genoa Asset Management

William (Kip) Weese

SVP, Intermediary Sales

Northeast & South West

(508) 423-2269

Email Kip

Rick Bell

VP, Intermediary Sales

North Central & North West

(513) 762-3694

Email Rick