June 9, 2023

The great funding has started. The US Treasury is rebuilding the Treasury General Account (TGA, The checking account at the Fed) by some estimates as much as $1 trillion. So where is that money going to come from, what is the potential impact and are there any opportunities?

This week the Treasury made some progress, increasing the TGA by some $29 billion. Most of the offerings were short and a few basis points higher than the Fed’s Reverse Repo facility. This week the money came from money markets rotating from the Fed to the new bills. But the raises are going to increase and terms are going to extend so the investor base will need to expand.

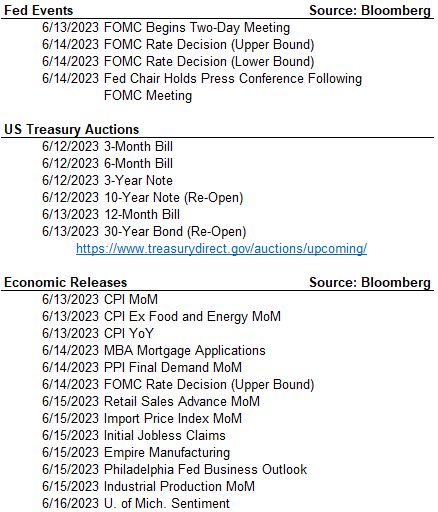

To expand that investor base, the Treasury will need to show better rates than other risk-free assets (Like the Fed’s reverse repo facility). That means higher short rates (2-Year and in) are coming, even if the FOMC does skip (The new pause) an Overnight Fed Funds hike at their June meeting next week.

Parallel to this raise, the Federal Home Loan Banks (FHLB) iare raising cash. To raise liquidity, many banks in the banking system utilized the Federal Home Loan system and taped their funding. This has caused FHLB to increase their market activity and to offer even better rates than the US Treasury, sometimes with structures that have interesting return possibilities.

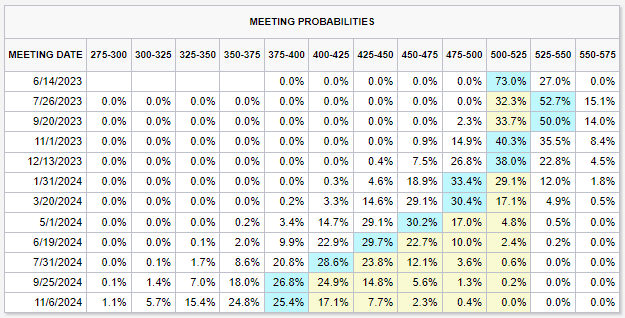

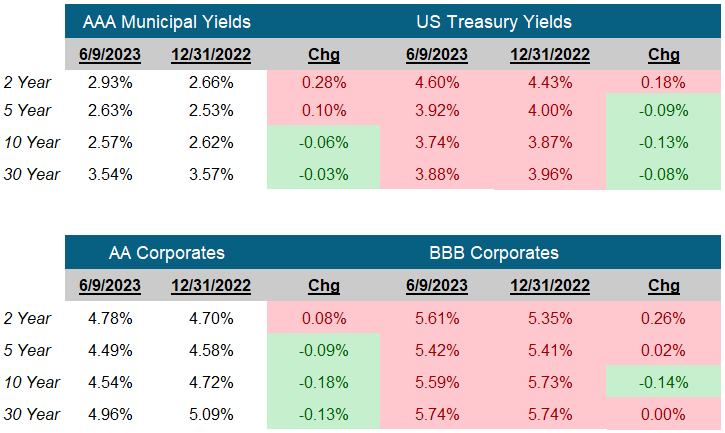

Given the employment numbers last week and this week and Fed officials signaling impatience with the rate of disinflation, futures now anticipate a 25 basis point increase in the Overnight Fed Funds Rate at the July Meeting (Skipping next week’s June meeting) and holding that 5.25-5.50% through November 1st and then holding the 5.00-5.25% level until the January meeting. That is higher and longer than expected just a few weeks ago when we were facing a banking crisis.

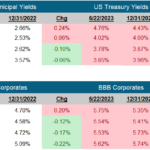

We continue to see opportunities in migrating out the curve and adding duration to fixed income portfolios. But with the likelihood of higher short-term rates (See above…), we think it’s setting up some opportunities in the short market. As we mentioned, the FHLB is busy raising funds, some of those funds are in callable notes (Bonds that can be redeemed prior to maturity at par at the option of the issuer). To get investors interested in the callable notes, the FHLB are offering attractive spreads to US Treasuries. One example: an FHLB 5.6% bond due 6-13-2025, callable 9-15-2023 at 100 (Par). We see the bond offered at a slight discount to par, for a 5.608% yield to maturity. Very attractive compared to the US Treasury with a 2.875% coupon due 6-15-2025 that yields 4.592%. But what about if they call the bond? The yield earned would be higher than 5.608%, much higher than the US Treasury Bill due 9/14/23 yielding 5.21%

If you are happy clipping 5%+ yields with little credit or rate risk, this is the market you have waited for. With all this demand for cash, the opportunity is even better for those willing to do the research and analysis.

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

Next FOMC Decision

June 14, 2023

The Week Ahead

CME Fed Watch Tool

Fixed Income Rates

Click on the above links for more information on important investment and economic concepts.

Contact Genoa Asset Management

William (Kip) Weese

SVP, Intermediary Sales

Northeast & South West

(508) 423-2269

Email Kip

Rick Bell

VP, Intermediary Sales

North Central & North West

(513) 762-3694

Email Rick