June 22, 2023

The FOMC held their meeting last week. From that we have a press release, press conference various speeches and congressional testimony. The overriding theme has been: Higher rates for longer (Note, we are back to Higher). But didn’t the FOMC just pause? If they are so worried to get inflation down to their 2% target, why wait?

Watch Chairman Powell’s press conference, as he struggles through rationalizing the pause, I mean, skip while expressing continuing concern about inflation and signaling more interest hikes before the end of the year. Looking at their discussion of the data, their multiple assurances of a 2% target and their concern inflation expectations will settle in, why pause? Last year this same Fed wanted to get ahead of the curve and raised rates at a historic pace, only to now pause and potentially lose momentum against inflation?

There are 34 days until the next FOMC meeting July 26, 2023. In that time, we will get over 60 economic and inflation reports including CPI, PPI, PCE, and GDP, not to mention the large banks will have reported their second quarter earnings and the US Treasury will have raised another several hundred billion to refill the Treasury Government Account (TGA). With all this data, perhaps our leading bankers will have a better read on the state of the economy and inflation than they do today.

At the May 3rd meeting they made changes to the statement and tone of the press conference to signal the end was near for rate increases. Speakers followed expressing confidence in the banking system and how the slowdown in lending would slow the economy and inflation. But as reports were released for Jobs, and CPI, it became apparent, they overestimated the impact of the mini banking crisis and economic and inflation readings were not cooperating.

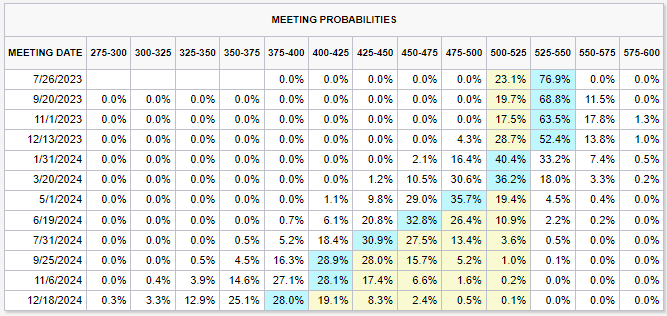

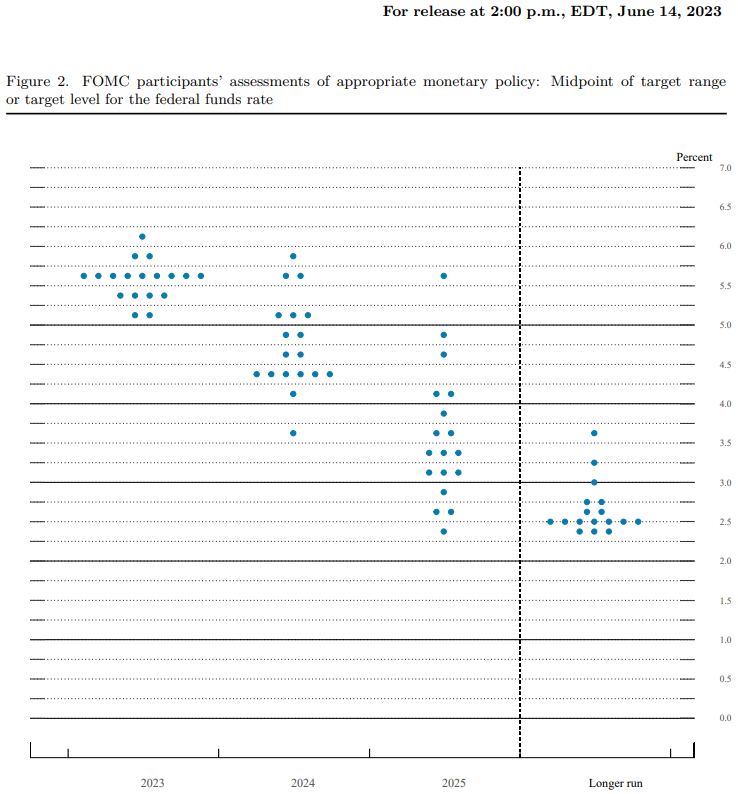

So where does this lead us? Leaning toward our third scenario: The FOMC emboldened by their ability to handle the mini-banking crisis and frustrated by the pace of disinflation will continue with rate increases. Pause, skip or whatever, the direction of short-term rates seems to be higher and held there through the end of the year. Look below at the FOMC Summary of Economic Projections: Midpoint of target level of federal funds rate chart (AKA: The DOT Plot). The Governors consensus is a 5.6% Fed Funds rate at year end. That indicates 50 bps more tightening from today’s 5-5.25%. According to the CME Fed Watch Tool below, the futures market is less convinced and only prices one 25 bps hike, with rates held steady through year end.

The good news? The nice yields on the short end of the curve will be around for a while. The better news? There is still time to average into longer maturities and benefit from lower rates that might come if the Fed is successful taming inflation. Averaging in now will lock in yields for a potentially lower yield future and set your portfolio for potential gains if rates do go lower.

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

Next FOMC Decision

July 26, 2023

The FOMC Dot Plot

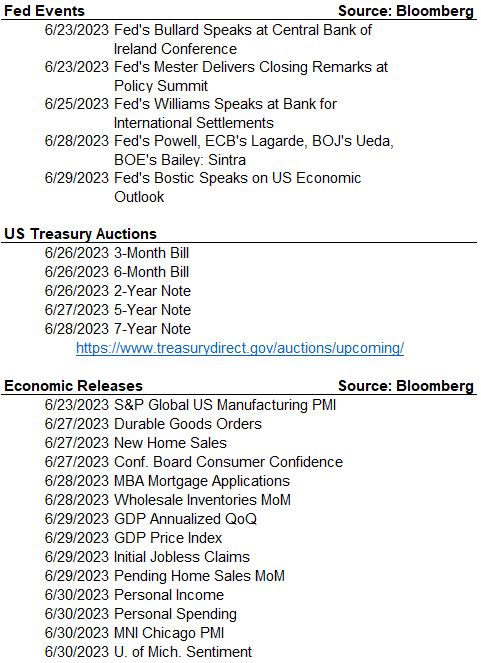

The Week Ahead

CME Fed Watch Tool

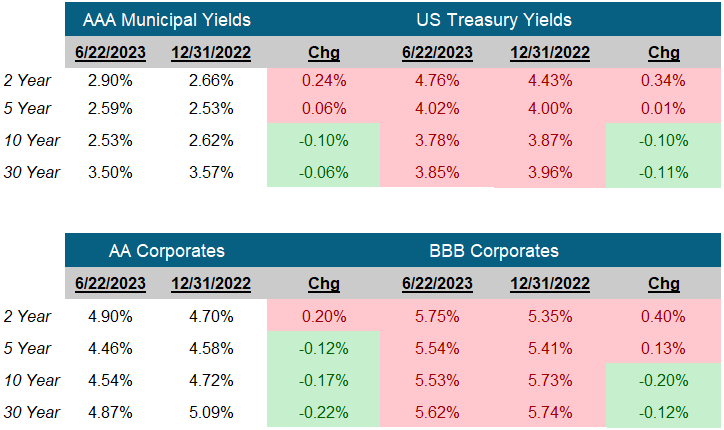

Fixed Income Rates

Click on the above links for more information on important investment and economic concepts.

Contact Genoa Asset Management

William (Kip) Weese

SVP, Intermediary Sales

Northeast & South West

(508) 423-2269

Email Kip

Rick Bell

VP, Intermediary Sales

North Central & North West

(513) 762-3694

Email Rick