March 10, 2023

Yesterday SVB Financial (SVB) parent company of Silicon Valley Bank announced they are doing a significant capital raise to cover losses from their portfolio of… Mortgage backed and Treasury Bonds. SVB stock dropped 60%, bonds and preferred issues were down significantly and Moody’s announced a downgrade of the credit (Always on top of the situation!). What the heck happened and why did it cause the KBW bank index to drop 7.7%?

Let’s take a step back, banks collect deposits, keep some of that cash in reserve and loan out the rest to support the economy (and make money). But in the last several years, banks haven’t been loaning much money, they have been buying mortgage backed and US Treasury bonds. There are many reasons, capital requirements, regulations, easy to implement and profitable. Because the bonds are not “Held for Sale”, The banks don’t have to mark their bonds to market even if the bonds are down 10-15%. They are matched against CD’s, savings and checking accounts earning them a nice spread, called Net Interest Margin. This all works until there is a run on the bank.

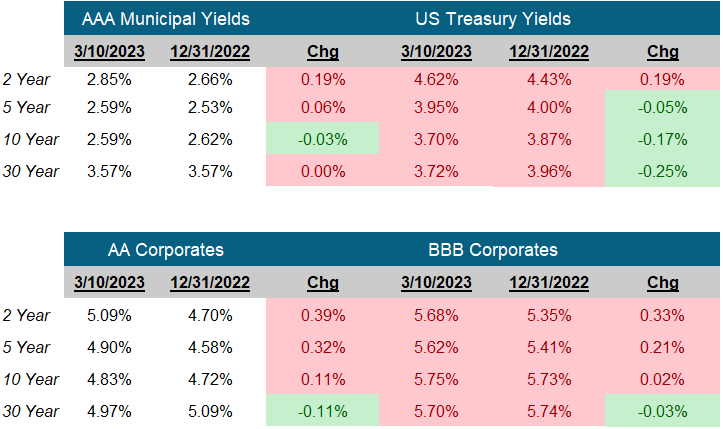

We’ve been waiting for the fallout of raising the Overnight Fed Funds rate 450 basis points, including an unprecedented four 75 basis point increases with 50 basis point increases before and after those. That fallout? Banks could not keep up. According to Bankrate.com the average saving account rate is 0.23%, and 1-year CD’s 1.59%. Banks can’t raise their deposit rates because they have legacy bonds with sub 1% coupons that they can’t sell because they have losses.

But now everyone can buy a 1-year US Treasury Bill and earn 4.90% (I hear there’s even an ETF for that!). What were once depositors are now investors as the US Treasury sucks the deposits out of the banking system. If SVB could have kept the deposits, they wouldn’t have needed to take the losses, but the deposits left in the millions and SVB had no choice but to sell the bonds at a loss to give depositors their money back. (More interesting will be, why didn’t they just go to the Fed’s Discount Window and get the deposits?)

SVB is not the only bank in this bind. I recently had lunch with a friend who is on the board of a community bank. He mentioned they were bleeding deposits. From small to big, banks are in trouble. Once again, this is a different crisis. It’s not credit, it’s a mismatch of assets (bonds) and liabilities (Deposits), and the deposits are just leaving, forcing the sale of the assets.

This is not good for the economy or credit spreads. The markets will now demand more return, increasing credit spreads until all the banks disclose their vulnerabilities. Banks are a huge part of the corporate bond market so this will ripple through the rest of the fixed income markets and into other markets.

SVB may be the only bank in this predicament, other banks may use the Discount window. The market is not going to wait, spreads are widening the effects are happening. For now, those ex-depositors look pretty smart, that 1-Year US Treasury Bill looks like a good place to consider for allocation in a portfolio.

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

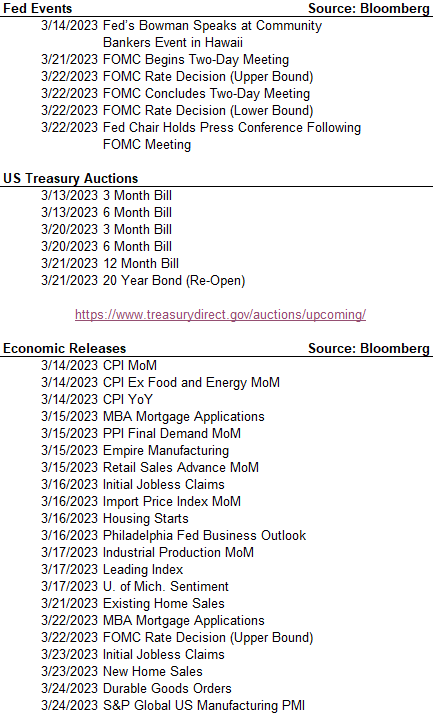

Next FOMC Decision

March 22, 2023

The Week Ahead

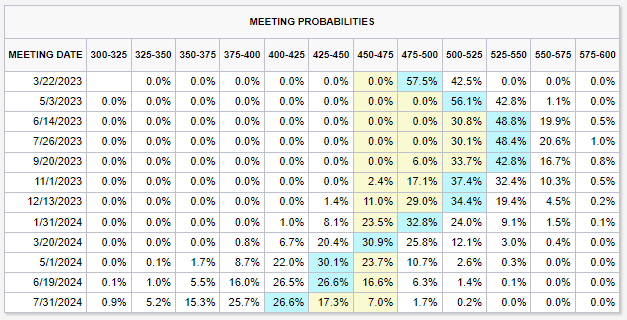

CME Fed Watch Tool

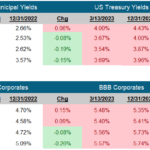

Fixed Income Rates

Click on the above links for more information on important investment and economic concepts.

Contact Genoa Asset Management

William (Kip) Weese

SVP, Intermediary Sales

Northeast & South West

(508) 423-2269

Email Kip

Rick Bell

VP, Intermediary Sales

North Central & North West

(513) 762-3694

Email Rick