March 13, 2023

Over the weekend, Silicon Value Bank (SIVB) and Signature Bank New York – SBNY were seized by regulators and First Republic Bank (FRC) taped additional liquidity. The Fed and the market listened to our post and took drastic action to stop the run on the banking system. This quick action aimed at saving depositors, reminded the markets how risky bank investing can be (Zero Is not a possibility, but a fact). It also brings into question: “How can the Fed raise rates when they just caused a banking crisis?”

SIVB was a classic Asset – Liability mismatch. Their assets were low yielding, long dated securities, marked at cost but trading at a loss, and their liabilities were deposits that were being wired out of the bank. SIVB was faced with having to sell the securities at a loss to meet depositor demand creating a run on the bank. SBNY, different and yet similar SIVB, had too many deposits from crypto platforms that were running off, spurring a run on the rest of the deposits. FRC, suffering bank-run contagion, taped resources to have the liquidity to meet depositor withdraws, without realizing losses on their security portfolio.

Meanwhile, the FDIC, The Fed and the US Treasury came together and quickly knitted a new banking bailout, essentially changing the rules for the Fed’s Discount Window to allow for unlimited size and the higher of 100% of face value or market value on any collateral presented. This facility would be a last ditch, pull the cord only in case of emergency facility. Likely any bank using this will face significant fallout in the value of their bonds and stocks (Witness the huge loss on FRC stock). But it does save depositors and keep the banking industry alive, while not giving Wall Street or Bankers a bailout. But depositors and investors are quickly waking up to the fact that banks can be fraught with risk and when those risks come to light, suddenly the worst-case scenario becomes the only scenario.

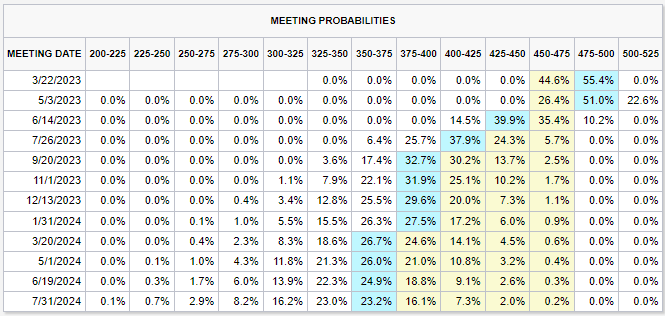

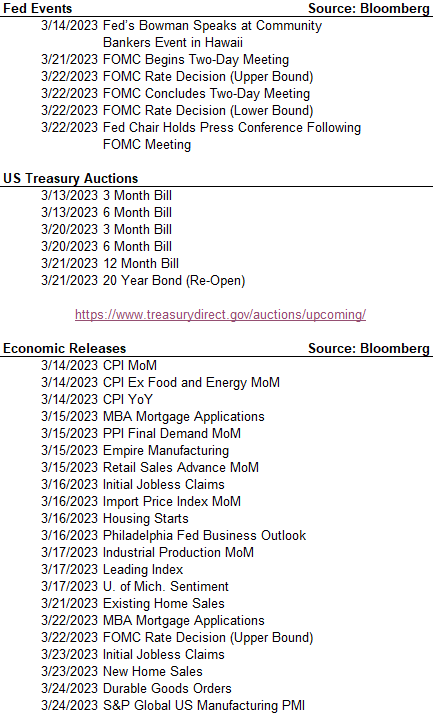

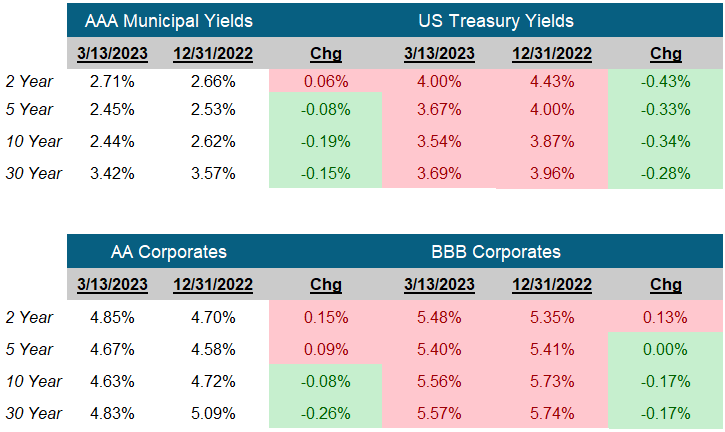

The good news in all this bad news? The market now believes “Higher for Longer” is now “Up 1, Down 5”. Futures now expect the Fed on March 23 to raise the overnight rates 25 basis points, hold a month and start cutting. Bank failures usually have a chilling effect on the economy. Banks, investors, and consumers could start to husband cash and pull away from risk. US Treasury Rates dropped across the curve (Prices are up!).

We are not one to say, we told you so, but we did. We have been warning of Too High, Too Fast and something will break. Something broke. Perhaps the Fed can contain the crisis. We don’t expect a 2008 level event, but like we said Friday, we do expect volatility until banks are transparent about their risk and liquidity levels.

Meanwhile, inflation may not have gotten the memo, the CPI numbers are released tomorrow. The Fed may have a high wire act ahead of it, and as we now see, no net for investors if they are wrong.

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

Next FOMC Decision

March 22, 2023

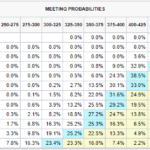

The Week Ahead

CME Fed Watch Tool

Fixed Income Rates

Click on the above links for more information on important investment and economic concepts.

Contact Genoa Asset Management

William (Kip) Weese

SVP, Intermediary Sales

Northeast & South West

(508) 423-2269

Email Kip

Rick Bell

VP, Intermediary Sales

North Central & North West

(513) 762-3694

Email Rick