March 17, 2023

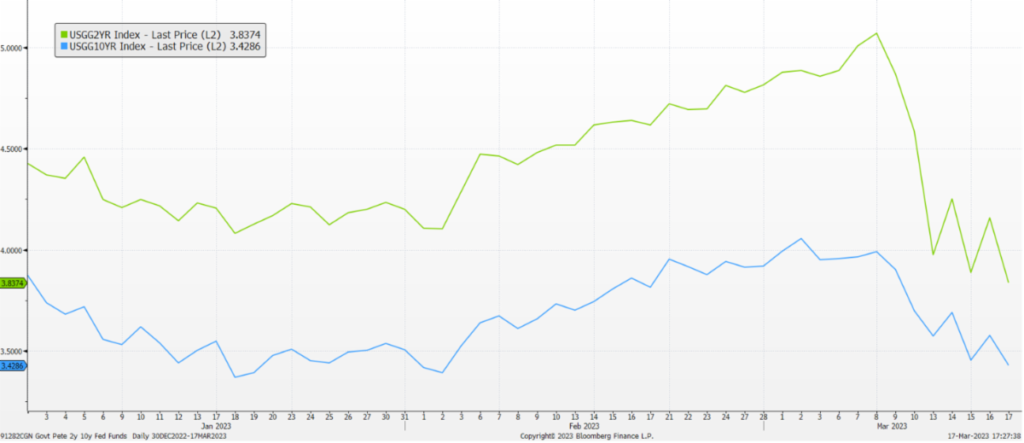

The market was a rollercoaster the last ten days, in particular the last week. On March 8th the 2-Year US Treasury yield was at 5.07%. By the 13th the yield sank (prices rose) to 3.98%. The note then proceeded to swing by 15-30 bps each day this week! Banking industry revelations, economic releases and central bank rate moves all combined for a wild week of curve riding.

Interest rates dropped as the market digested the new banking crisis. As we said, banks will have to disclose more information about their asset, liabilities and their configuration. Those banks that seem to have a mismatch will need to quickly address the issue, preferably before depositors and the market do it for them. First Republic is a good example, they may survive, but they may not stay independent. However, the industry, as a whole, seems healthy. Capital is strong, credit quality is strong, interest rates management, remains to be seen.

Importantly, as banks reassess their vulnerability to an internet paced bank run, they shored up their defenses. Their first move was getting liquid, the Fed’s discount window had a record 152.8 billion in borrowings, surpassing the all-time high in 2008. The next move might be to cut costs, shedding assets and liabilities that are not profitable and likely a few people associated with those programs (Did we mention the Fed wanted a weaker job market?). After that, the banks start reporting around mid-April, expect a lot of disclosure and discussion about this subject.

The CPI report was not helpful, showing consistent inflation pressures (Interest Rates Swing Up), but the PPI report showed good progress on inflation (Interest Rates Swing Down).

Credit Suisse, the Swiss bank to the worlds rich, suddenly found it’s window for a turnaround closing. The turnaround was nothing new, but the market losing patience with it forced the Swiss Central bank to step in and provide significant support. However, despite that crisis, the European Central Bank raised their Overnight rate by 50 basis points (Interest Rates Swing Up).

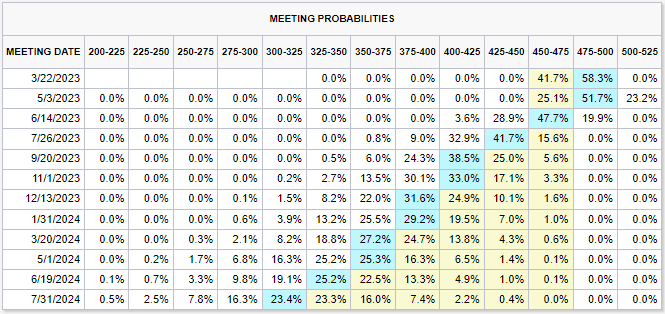

Lest we forget next Tuesday, March 22, 2023 (Dare we say the new Ides of March?) is the next Fed meeting. Looking at the CME FedWatch tool, futures still predict a 25-basis point increase. How can the Fed raise rates at the beginning of a potential banking crisis? Because they feel they can. They have the tools to deal with the problem banks and market disruptions. Once more, what they say will be as important as the actual rate change. If they continue to say, “Higher for Longer”, we are back on the roller coaster. If they say, data dependent or concerns about economic growth rates could be more stable. It seems a recession is more likely, and with the banks reassessing, likely it’s not a soft-landing anymore.

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

Next FOMC Decision

March 22, 2023

2-Year (Green line) and 10-Year (Blue line) Yields

3 months ended 3-17-23

Source of Interest Rates: US Treasury Yields via Bloomberg LP see footnote at the bottom of this e-mail for which indexes are used.

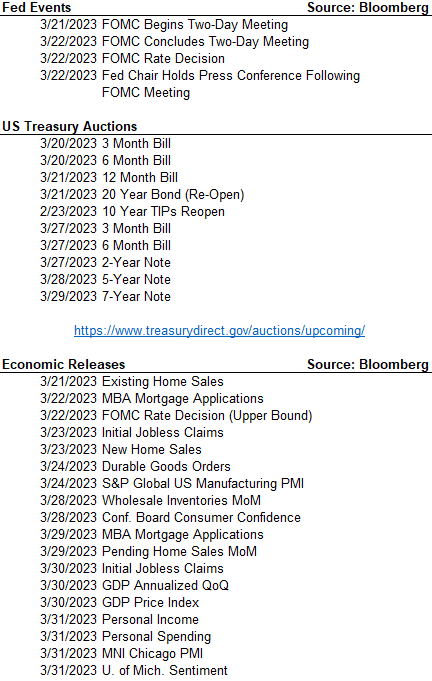

The Week Ahead

CME Fed Watch Tool

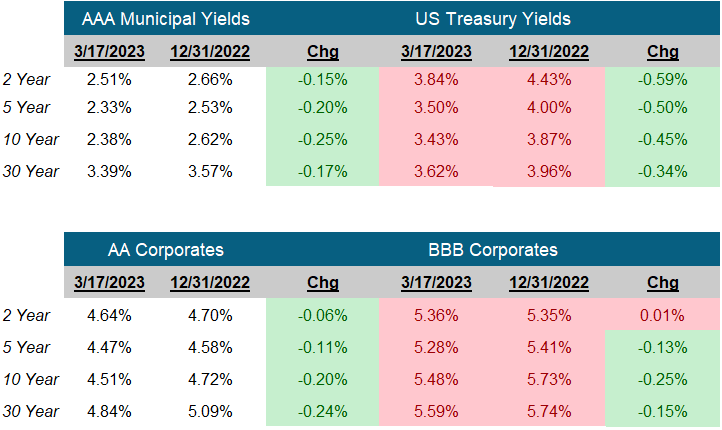

Fixed Income Rates

Click on the above links for more information on important investment and economic concepts.

Contact Genoa Asset Management

William (Kip) Weese

SVP, Intermediary Sales

Northeast & South West

(508) 423-2269

Email Kip

Rick Bell

VP, Intermediary Sales

North Central & North West

(513) 762-3694

Email Rick