March 31, 2023

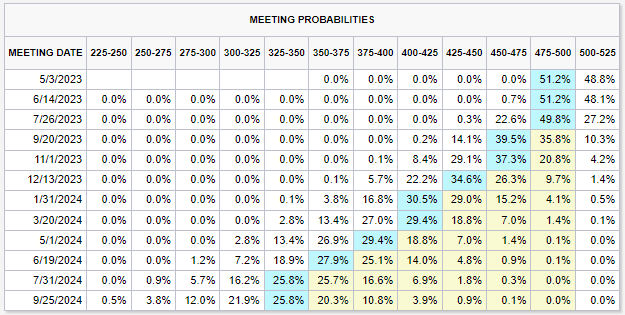

Finally, the Fed’s historic rate increases have broken something in the economy (We did say they would, several times). You could almost hear the sigh of relief from Washington. A second sigh was heard after the markets calmed this week, and no more banks failed, here or in Europe. The biggest sigh came from the markets when the Fed switched from “Higher for Longer” to “Data Dependent”, also known as a Pivot.

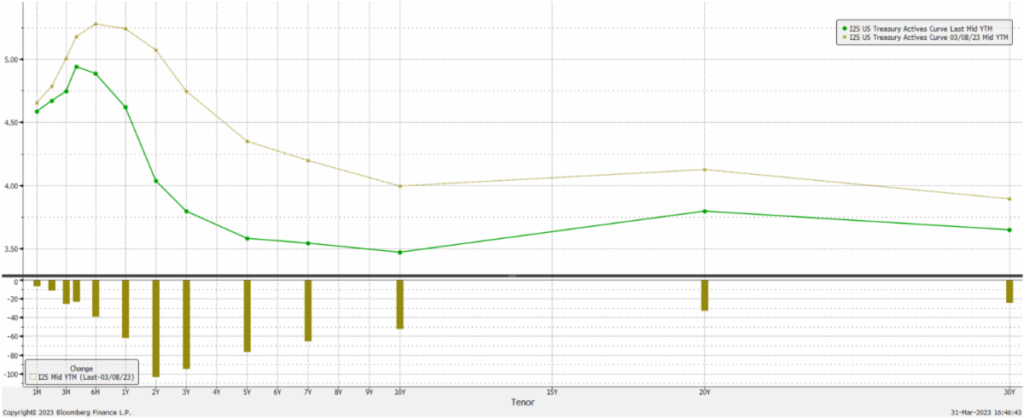

Silicon Valley Bank (SIVB) was felled by it, now the run has spread to other banks. Bank runs are going viral as deposits are wired out of smaller banks at the speed of the Internet. This is a direct result of the Fed’s actions: Dropping rates, Increasing the money supply, then Raising Overnight rates at a historic pace. This pace gave banks little to no time to reposition their portfolios and mitigate their losses before the next rate increase. Even worse, saddled with low yielding bonds, banks deposit rates quickly became uncompetitive with bonds issued by our very own US Government. On March 8th, the 2-year US Treasury yield hit 5.07%, depositors became investors, SIVB failed, and the mini-Bank run of 2023 was started. Will it spread? We don’t think so, perhaps a few banks will merge, but we will know more when banks start reporting in a few weeks.

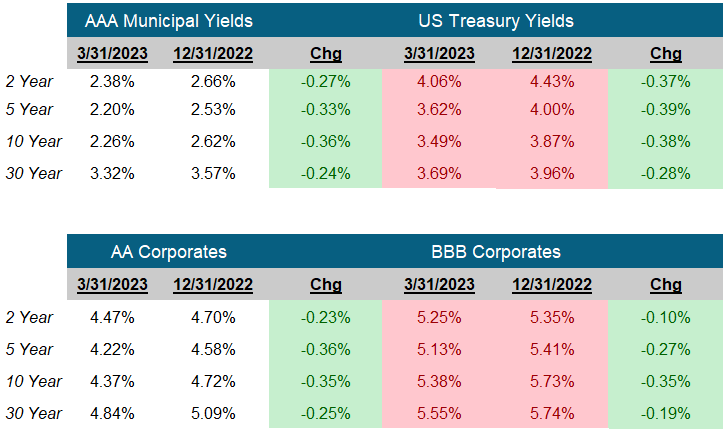

So once again bad news is good news. If smaller regional banks are losing deposits they can’t keep making loans and that should slow the economy. A slower economy might lead to less inflation. In a speech today John Williams, President of the New York Fed, put it best: “The economic outlook is uncertain, and our policy decisions will be driven by the data and the achievement of our maximum employment and price stability mandates,” That is 180 degrees away from the old “Higher for Longer”. What was 5.07% on the 2-year is today’s 4.06%.

The really good news? The yield on the 10-Year dropped from 4.06% on March 2nd to 3.49% today. If the Fed stays data dependent and the good inflation news keeps coming (PCE was better than expected), we may have seen peak rates and potentially may see rates across the curve could come down. Lower rates mean higher bond values, especially for the long US Treasuries and mortgage bonds held at banks!

We have been saying the Fed was going a hike too many for a while. We believe the effects of the raises are working their way through the economy and inflation should cool. After SIVB, the Fed has finally come around to our thinking (and caused a potential hard landing). We particularly think the 7-10 year range has attractive return possibilities for the duration risk you are assuming.

There is a saying in the markets: Don’t fight the Fed. Buy Intermediate to Long US Treasuries.

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

Next FOMC Decision

May 3, 2023

US Treasury Yield Curve

3-8-23 vs 3-31-23

Source of Interest Rates: US Treasury Yields via Bloomberg LP see footnote at the bottom of this e-mail for which indexes are used.

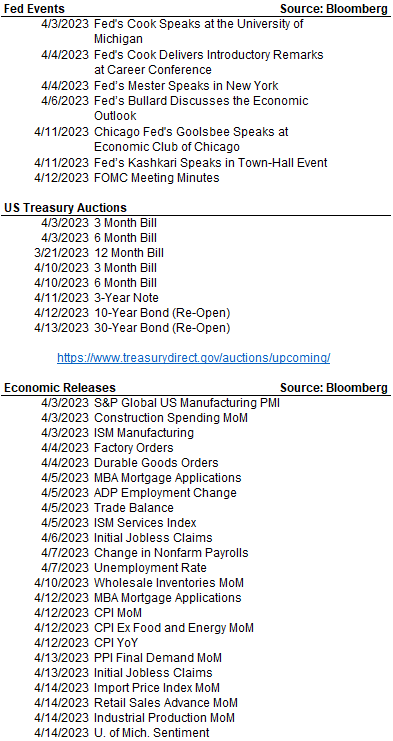

The Week Ahead

CME Fed Watch Tool

Fixed Income Rates

Click on the above links for more information on important investment and economic concepts.

Contact Genoa Asset Management

William (Kip) Weese

SVP, Intermediary Sales

Northeast & South West

(508) 423-2269

Email Kip

Rick Bell

VP, Intermediary Sales

North Central & North West

(513) 762-3694

Email Rick