April 7, 2023

Is inflation tamed? Are the banks going bust? Are we in for a hard landing? Those are the questions of the moment. After this week and next we should have more clarity. With the ISM, JOLTS, and Jobs reports we got some of the answers, with the CPI, PPI and Retail Sales reports next week (Along with others) we should get some more. Likely, all the reports put together will not give us a definitive answer, but we should have clarity on the potential need for more Overnight Fed Fund rate hikes.

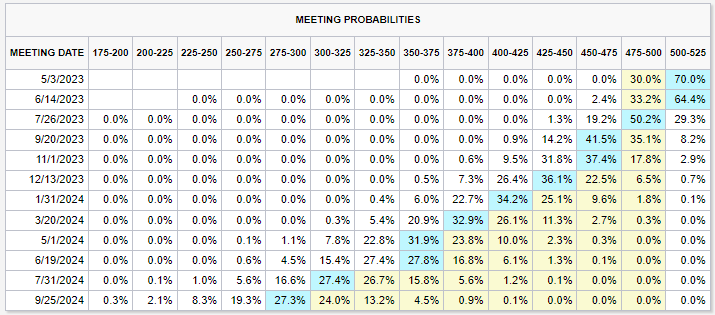

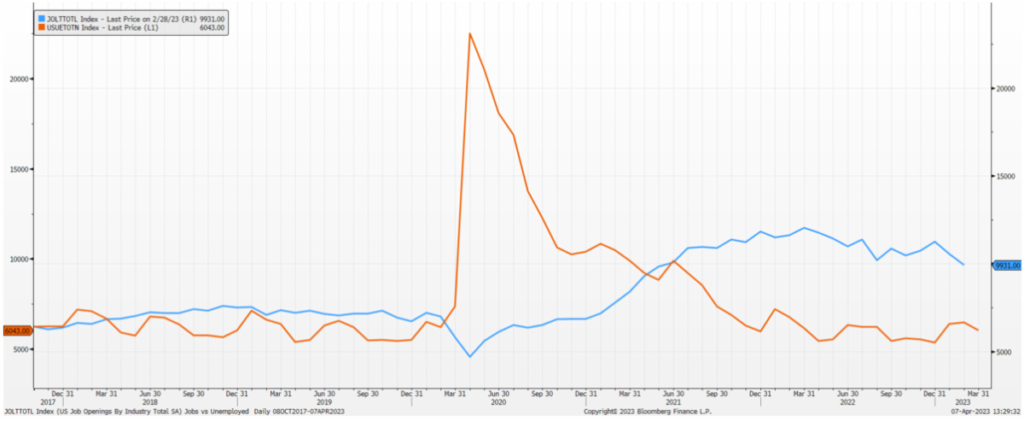

This week, the news on the jobs front was good, and that was bad. The JOLTS report showed job openings decreased by 632,000 (6%) which shows some cooling in the job market, but as you can see in the graph below, we still have a large gap between job openings and the people looking for jobs. Next, the March Jobs Report showed good strength with a solid gain in non-farm payrolls, an upward revision to February’s Non-Farms Payrolls, and a 3.5% Unemployment Rate. Combined, these two reports give ample room for the FOMC to increase rates at their next meeting.

The CPI and PPI numbers next week will give us a current read on inflation. Expectations are for both to show continued cooling of inflation, but any good news will be tempered by concern from the rise in Oil prices this week from OPEC+’s production cuts. Retail sales will round out the end of the week, giving us insight into the health of the consumer (and their credit cards).

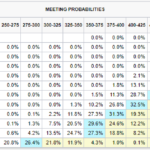

With the Jobs report, Treasuries gave back some of their gains, and the futures pointed to more Overnight Fed Fund increases. The CME FedWatch Tool now indicates a 25-basis point increase (Bringing the Top rate from 5% to 5.25%) at the next meeting. Our concern, with the potentially abridged banking crisis and continued job market resilience, the FOMC could become emboldened feeling they can raise rates and handle whatever they break (Again).

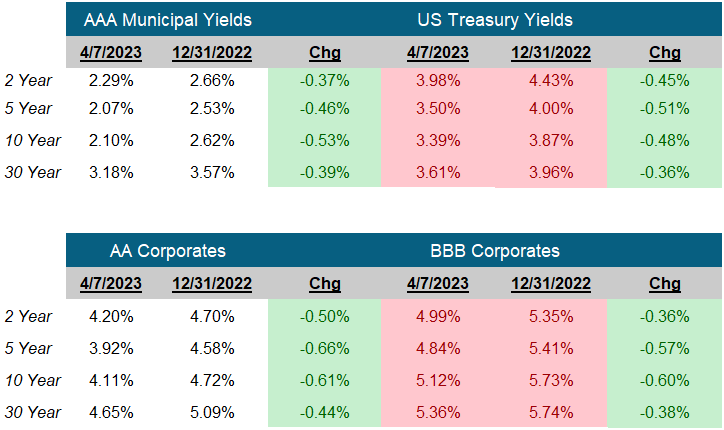

One potential winner might be long bonds. Since March 2nd the 10-Year US Treasury yield has fallen from 4.06% to 3.31% or 74 bps. With that yield move, the ICE BofA Current 10-Year US Treasury Index returned 6.89%. Since March 8th the 2-Year US Treasury has dropped from 5.07% to 3.83% or 124 basis points and, the ICE BofA Current 2-Year US Treasury Index returned 2.55%. If the Fed re-asserts the need to fight inflation, a barbell structure (some of the portfolio very short and some of the portfolio long) could do well, capturing high short term yields and performance from potentially lower yields.

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

Next FOMC Decision

May 3, 2023

US Jobs Openings vs Unemployment

10-31-17 vs 3-31-23

Source of Interest Rates: US Treasury Yields via Bloomberg LP see footnote at the bottom of this e-mail for which indexes are used.

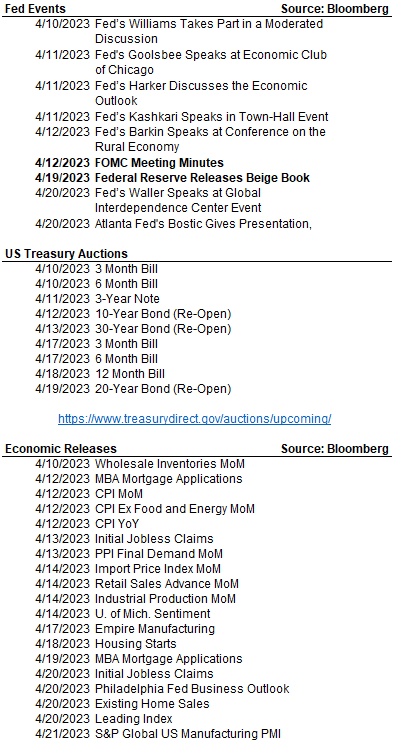

The Week Ahead

CME Fed Watch Tool

Fixed Income Rates

Click on the above links for more information on important investment and economic concepts.

Contact Genoa Asset Management

William (Kip) Weese

SVP, Intermediary Sales

Northeast & South West

(508) 423-2269

Email Kip

Rick Bell

VP, Intermediary Sales

North Central & North West

(513) 762-3694

Email Rick