February 24, 2023

Sometimes markets can be clear, and you can see direction for as far as the eye can see. Other times, the vision is hazy, cloudy, or even stormy. Uncertain times make us long for clarity. We regularly run through an exercise to identify the source of the uncertainty and find a path forward. We call it “What do we know, we know, we know?” (Get it? Triple sure…)

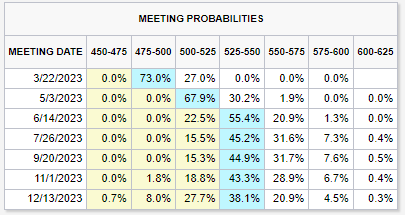

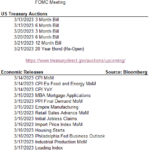

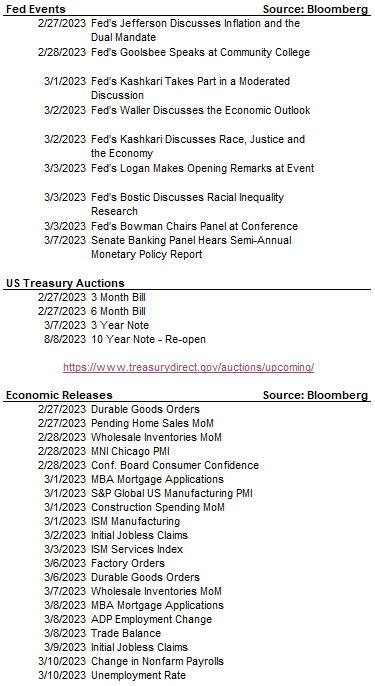

First, start with what we know. For example, we know this is the third year of the US Presidency and there will be an election in November 2024. We know the Fed started raising rates at 0.25% (Top Rate) and right now the Top Rate is 4.75%. We also know the next FOMC announcement is March 22, 2023. We are making huge progress!

What don’t we know? What will the terminal rate be for the Overnight Fed Funds Rate? When will we reach that rate? Will the economy go into a recession? Is inflation finished increasing? The list can go on, but the important part is we have identified some of the things we don’t know.

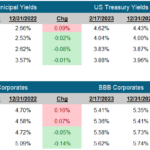

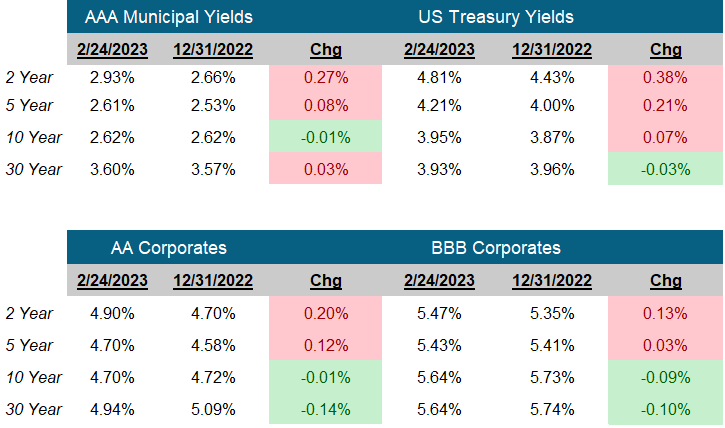

With these two lists, we now start to work. Given the things we know, are there any conclusions we can draw from that? How about, we can get much better yields now in short US Treasuries? More importantly, of the things we don’t know, what do we know about them? For instance, When the yield on the 10-year US Treasury note and the 3-month US Treasury Bill invert, that has historically been a good indicator of a potential recession in the future.

Does any of this help? Absolutely, by identifying the uncertainty we might define timeframes, access risks, or even forecast probabilities. Now, we have clarity and perhaps a path forward.

Be aware, you may know what you know, and you may know what you don’t know, but there may unknowns neither you nor the market know, and they may happen, surprising everyone. Create a plan for this. Make a note to your future self, open in case of market meltdown. What steps to take, what to potentially sell, what to potentially buy and most of all, don’t panic. This worked well for us in 2008 and 2020 and we are confident it will work well when volatility strikes again.

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

Next FOMC Decision

March 22, 2023

The Week Ahead

CME Fed Watch Tool

Fixed Income Rates

Click on the above links for more information on important investment and economic concepts.

Contact Genoa Asset Management

William (Kip) Weese

SVP, Intermediary Sales

Northeast & South West

(508) 423-2269

Email Kip

Rick Bell

VP, Intermediary Sales

North Central & North West

(513) 762-3694

Email Rick