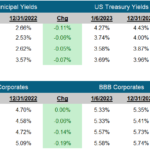

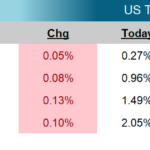

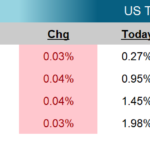

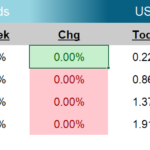

Fixed Income Market Update

February 24, 2023 Sometimes markets can be clear, and you can see direction for as far as the eye can see. Other times, the vision is hazy, cloudy, or even stormy. Uncertain times make us long for clarity. We regularly run through an exercise to identify the source of the uncertainty