January 13, 2023

Investing in fixed income is all about hierarchy. At the top are US Treasuries. They are the safest, most liquid fixed income investments in the market. Every other fixed income security trades off where the corresponding US Treasury issue is trading. That is for good reason, if you can buy a risk-free US Treasury at a similar or better yield, you should sell the risk asset (E.g. a corporate bond) and buy the US Treasury, or a better yielding corporate bond.

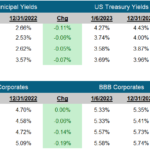

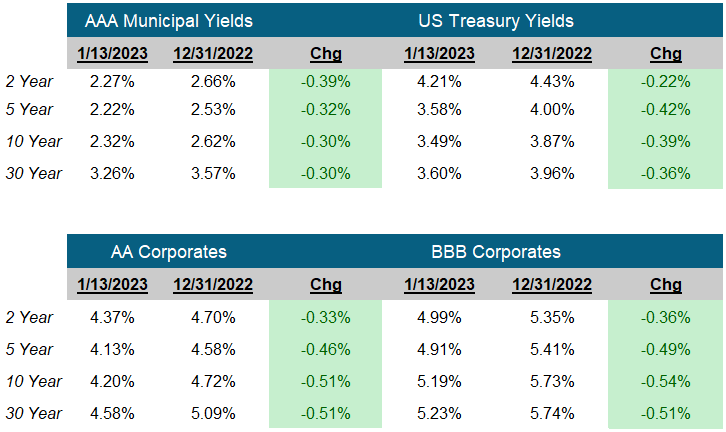

Tax Free Municipal bonds also trade in relation to US Treasuries. But the tax-exempt interest requires a different formula. Rather than being “Spread” off of treasuries tax-free municipal bond yields typically trade as a percentage of US Treasury yields (Look below, the 2 year AAA Muni yield is 53.86% of the 2 Year US Treasury Yield). Historically, this relationship varies from 75-85% of US Treasuries.

Let’s look at this another way. Investors buy tax-free municipals to avoid paying income taxes on the coupon interest from the bond. A Taxable Equivalent Yield is calculated from the tax-free yield to compare it to taxable yields like US Treasuries (Helpful: Tax-free to taxable equivalent yield tables). Like our corporate bond example above, if the taxable equivalent yield is lower than the corresponding US Treasury, you should sell the municipal bond and buy the US Treasury. For an investor in the 35% federal tax bracket the 2-year AAA municipal yield of 2.27% is a tax equivalent yield of 3.49% versus the 2 Year US Treasury Yield of 4.21%…

Why is this? Historically, municipal bonds perform well through recessions and investors are adding them to their portfolios. They are assuming they can’t make a mistake if they invest inside of two years. But they are. Investors who are buying short duration or short maturity tax-free bonds, municipal funds, SMA’s or ETFs, would do better to buy short US Government bonds, funds, or ETFs. Even after the additional taxes. The potential additional income (and performance) might even be enough to offset any taxes on gains generated on the sale of the short municipal bonds.

This is yet another part of active portfolio management. Recognizing bubbles and avoiding them. Not following rules to avoid mistakes, just to end up making a mistake.

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

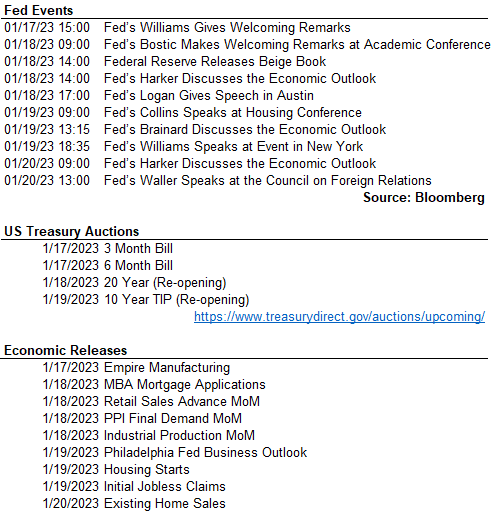

Next FOMC Decision

February 1, 2023

The Week Ahead

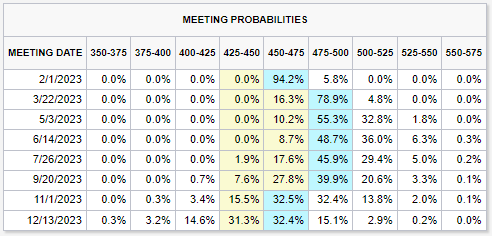

CME Fed Watch Tool

Fixed Income Rates

Click on the above links for more information on important investment and economic concepts.

Contact Genoa Asset Management

William (Kip) Weese

SVP, Intermediary Sales

Northeast & South West

(508) 423-2269

Email Kip

Rick Bell

VP, Intermediary Sales

North Central & North West

(513) 762-3694

Email Rick