Written by Peter Baden, CFA, Chief Investment Officer

Headlines of the Week

Taper now or Taper Later?

That is the question on the markets mind. Analyzing the various economic tea leaves, the Fed could easily justify starting the Taper now or they could justify starting in November, December or even 2022. The important part of that question is, when not if.

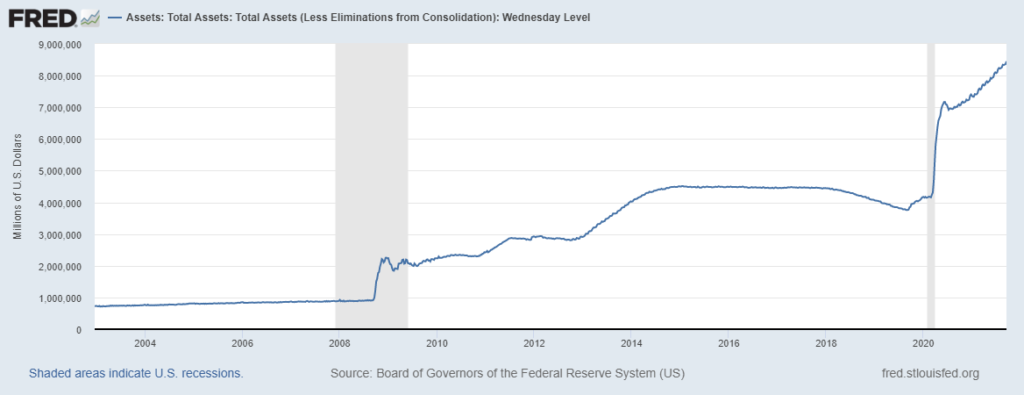

A quick review, as part of their extraordinary support for the markets and economy last year, the Fed is purchasing fixed income securities (Mostly US Treasuries and Agency issued Mortgage Backed Securities) every month. This adds liquidity (Cash) into the banking system and keeps a floor on prices for those assets (and to a certain degree other riskier assets) and dampens volatility. But these purchases are extraordinary measures, and the Fed does not intend to keep them in place forever. Rather than just stop the purchases, the Fed will likely “Taper” the bond buying program, reducing the amount purchased each month. Eventually the Fed will “Maintain their Balance Sheet” and reinvest the cash flows and maturities from their portfolio. Then, if circumstances allow, they will allow cash flows and maturities to “Run Off” and let the Fed Balance Sheet shrink.

So, the Taper is going to happen. The Fed has clearly telegraphed they are discussing when to start. The market seems to have taken this in stride. Interest rates are lower and stock are higher since the Fed first announced, taking about taking about the Taper.

The real question on the market’s mind? When does the Fed start raising the Fed Funds Rate? Some Fed Governors have alluded that the decision to Taper and the decision to raise rates are not connected. Some even believe the sooner we taper the longer we can keep interest rates low. While that remains to be seen, the Dots from the Fed Governors economic forecasts are estimating the Fed Funds Rate rising in mid-2023.

The CPI ex-Food and Energy numbers were better than Bloomberg consensus estimates at 0.3% MoM and 4.0% YoY. While they were high compared to the last ten years, they are within the Fed’s expectations and the momentum higher seems to have cooled. Retail sales came in unexpectedly strong at +0.7% beating the -0.7% Bloomberg consensus and rebounding from last month’s revised -1.8%. Both of these readings would seem to support the Fed’s current path: continued low rates but starting to Taper.

The Fed meets on Tuesday and Wednesday next week, markets expect to hear more on the timing of the Taper and their analysis of the current economic state. We also have the housing numbers next week with Starts (Tuesday), Mortgage Applications and Existing Sales (Wednesday).

Chart of the Week

Source: St. Louis Fed

As of: 9/15/2021

Click on the above links for more information on important investment and economic concepts.

Disclosures

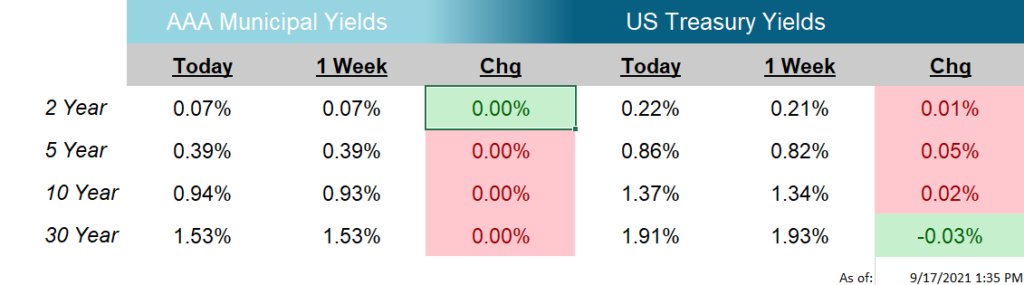

Indexes used for AAA Municipal Yields

2 Year: BVAL Municipal AAA Yield Curve (Callable) 2 Year (Symbol: CAAA02YR BVLI)

5 Year: BVAL Municipal AAA Yield Curve (Callable) 5 Year (Symbol: CAAA04YR BVLI)

10 Year: BVAL Municipal AAA Yield Curve (Callable) 10 Year (Symbol: CAAA10YR BVLI)

30 Year: BVAL Municipal AAA Yield Curve (Callable) 30 Year (Symbol: CAAA30YR BVLI)

Indexes used for US Treasury Yields

2 Year: US Generic Govt 2 Year Yield (Symbol: USGG2YR)

5 Year: US Generic Govt 5 Year Yield (Symbol: USGG5YR)

10 Year: US Generic Govt 10 Year Yield (Symbol: USGG10YR)

30 Year: US Generic Govt 30 Year Yield (Symbol: USGG30YR) F/m Investments, LLC, doing business as Genoa Asset Management (Genoa), is an investment advisor registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information please visit: https://adviserinfo.sec.gov/ and search our firm name. The opinions expressed herein are those of Genoa and may not come to pass. The material is current as of the date of this presentation and is subject to change at any time, based on market and other conditions. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. The information presented does not involve the rendering of personalized financial, legal or tax advice, but is limited to the dissemination of general information for educational purposes. Please consult financial, legal or tax professionals for specific information regarding your individual situation. This information does not constitute a solicitation or an offer to buy or sell any securities. Although taken from reliable sources, Genoa cannot guarantee the accuracy of the information received from third parties. Charts, diagrams, and graphs, by themselves, cannot be used to make investment decisions. Investing involves risk of loss, including loss of principal. Past performance is no guarantee of future results. An index is a portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Indexes are unmanaged portfolios and investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.