August 4, 2023

The consensus is in, we are heading for a soft landing. But someone forgot to tell the bond market. If we are heading for a soft landing, aka All Set no recession, how does the currently inverted curve, un-invert?

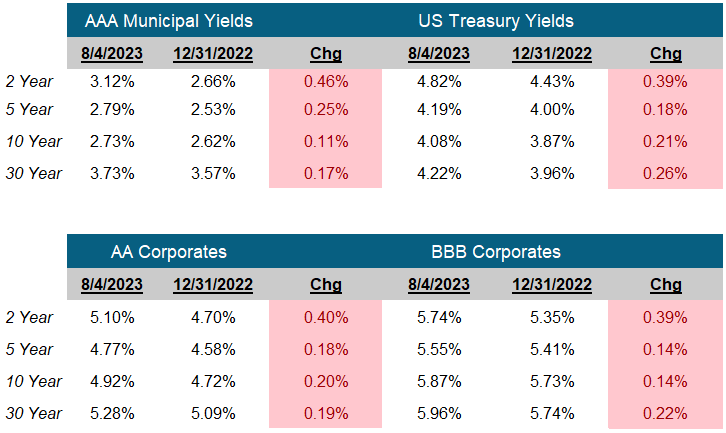

Typically, long US Treasury rates are higher than short US Treasury rates. If you’re going to take more time risk, you should get paid more. Because of the Fed’s efforts, short term notes like the 2-year US Treasury and long-term bonds like the 10-year US Treasury are yielding around 4.08% and 4.82%, respectively so the yield curve is inverted.

So, how does the yield curve un-invert from here? We see four scenarios:

1. No recession, inflation cools quickly and the FOMC can lower overnight rates sooner than expected. Potential Impact: Short rates fall, and long rates are stable to lower based on the lower FOMC rates and the direction of inflation.

2. Recession, Inflation cools and the FOMC must lower rates to support the economy. Potential Impact: Short rates fall, and long rates fall as people buy the safe haven 10 Year US Treasury.

3. No recession, inflation cools, but not quickly. Potential Impact: Short rates high for a longer period and long rates are stable to higher based on the direction of inflation and short-term interest rates.

4. No recession, inflation remains stubborn. Potential Impact: Short rates higher and long rates higher as the Fed is unable to put inflation back into the bottle.

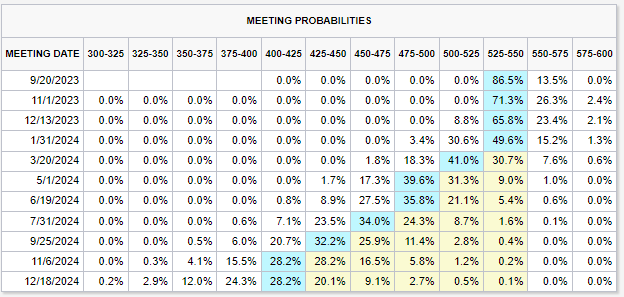

We don’t believe each scenario has an even chance of happening. Looking at the CME FedWatch tool below, the futures market would lean toward short rates staying stable for 7 months until March (Perhaps Scenario 1? 3?).

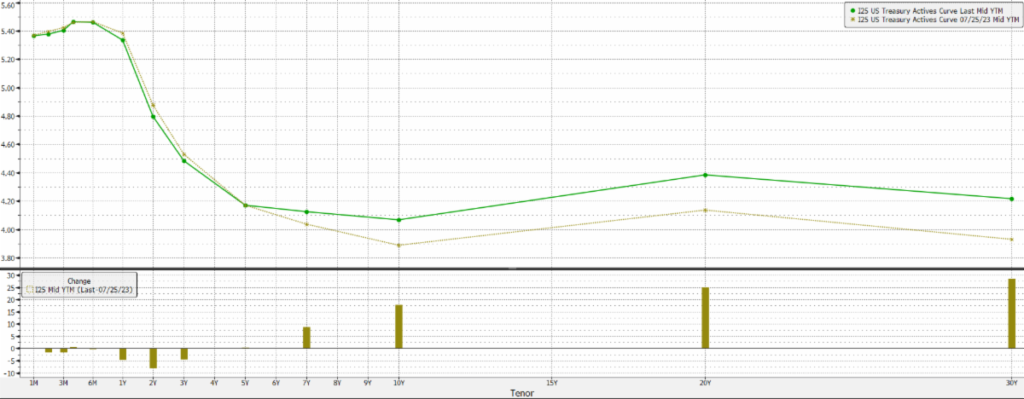

Looking at the yield curve below. The gold line was 7-25-23, the day before the last overnight rate hike and the green line is today. Since the Fed meeting, Short rates are slightly lower and long rates are higher (Scenario 3?).

Our analysis has shown as short-term rates peak (i.e., the FOMC is done raising rates), Long-term rates peak and start declining. But nothing in the market moves in a straight line. We still recommend averaging into longer term securities to capture these attractive yields and potentially get capital gains if long-term rates decline. (Scenario 1).

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

Next FOMC Decision

September 20, 2023

Yield Curve Steepens Since 7-25-23

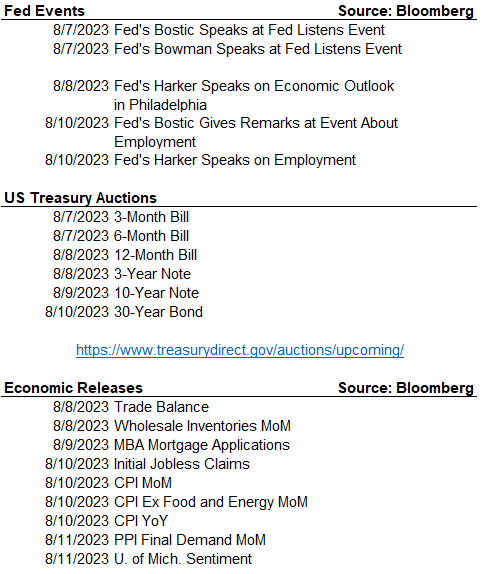

The Week Ahead

CME Fed Watch Tool

Fixed Income Rates

Click on the above links for more information on important investment and economic concepts.

Contact Genoa Asset Management

William (Kip) Weese

SVP, Intermediary Sales

Northeast & South West

(508) 423-2269

Email Kip

Rick Bell

VP, Intermediary Sales

North Central & North West

(513) 762-3694

Email Rick