July 28, 2023

A dovish Fed meeting, a solid GDP report and an encouraging PCE report all supported the soft-landing scenario. However, fixed income markets responded negatively as investors realized just how long rates may stay high and what that might mean for the curve.

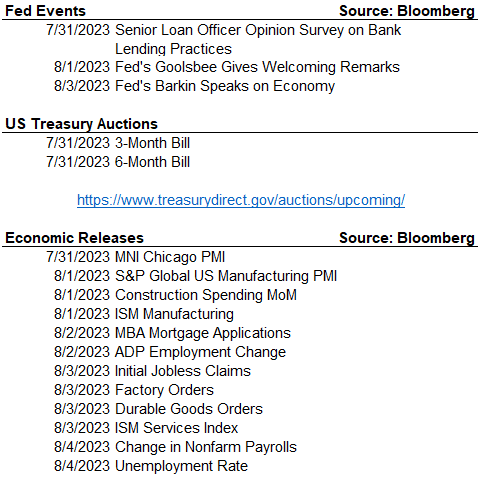

Wednesday the FOMC raised the Overnight Fed Funds Rate 0.25% (25 basis points) to a range 5.25% – 5.50%. This is the highest rate since 2001. In the press conference, the Chairman indicated the FOMC remains “Data Dependent” on future increases. He also indicated that the current Overnight rate was restrictive, given near term inflation expectations. Further, he expects inflation to potentially return to the 2% target sometime in 2025 and that they could start lowering rates before they hit the 2% target, even if they were still shrinking the balance sheet (aka Quantitative tightening). As a side note, he mentioned the Fed staff, who produce an outlook for every meeting, no longer forecast a recession for 2023. So, almost the definition of soft-landing, rates are restrictive, the FOMC is data dependent if higher rates are needed, no near-term recession and we could see cuts prior to 2025 when he forecasts inflation returning to 2%.

The second quarter Annualized quarter over quarter GDP of 2.4% was stronger than the 2% growth in the first quarter. Rather than shrink, economic growth seems to be accelerating.

Add to this the June PCE Core Deflator reading of 4.1% year over year, down from 4.6% in May, and you get a picture of inflation decelerating and supporting a FOMC on the sideline.

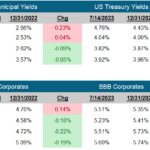

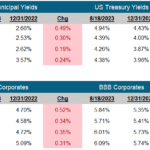

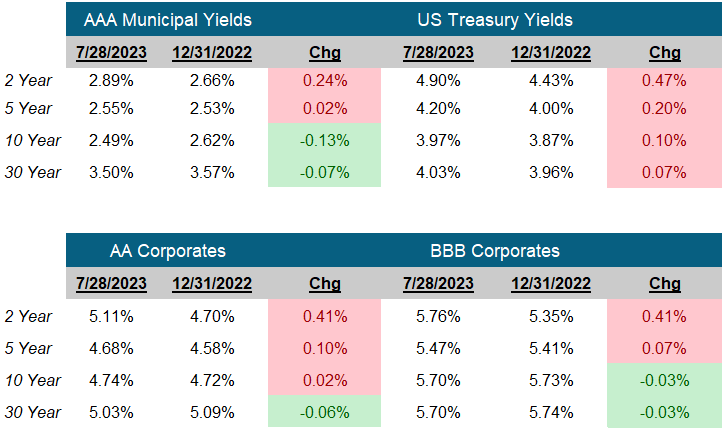

With all this great news, the US Treasury curve Bear steepened (Long rates rose more than short rates increased).

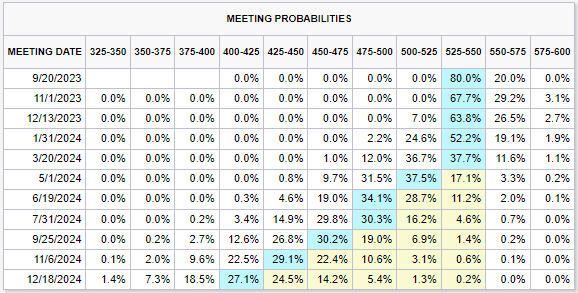

Markets, like my kids on a road trip, are impatient. Prior to the meeting, markets were forecasting rate cuts early in 2024. Recognizing the Chairman’s forecast, the economic growth and the pace of disinflation moved the timeframe for potential cuts well into 2024 (No we are not there yet!), the markets reacted and adjusted for a longer trip.

This is good news for fixed income investors! Short-term bonds potentially keep yielding high into 2024. Long-term bonds also have good yields and if inflation cools, could potentially see capital gains as rates decline. The soft-landing scenario also improves the outlook for higher quality corporate bonds as an improving economy could reduce the risk of default. We remain cautious on lower quality (High yield) fixed income, as highly levered companies will struggle to refinance debt at these higher yields.

Don’t worry kids, we have a way to go, but the ride just might be more enjoyable!

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

Next FOMC Decision

September 20, 2023

The Week Ahead

CME Fed Watch Tool

Fixed Income Rates

Click on the above links for more information on important investment and economic concepts.

Contact Genoa Asset Management

William (Kip) Weese

SVP, Intermediary Sales

Northeast & South West

(508) 423-2269

Email Kip

Rick Bell

VP, Intermediary Sales

North Central & North West

(513) 762-3694

Email Rick