September 15, 2023

Okay so the 1974 PR effort by President Ford was considered to be one of the biggest government public relations blunders ever, but perhaps it has application now? As the FOMC gathers next week to decide whether to raise, pause or hold; we say: Whip Inflation Now!

This is no public relations stunt to get Americans to save, carpool and spend less, this is: Get this over with now and do your best to avoid the consequences of waiting.

Next week at the FOMC meeting the Chairman will try to maintain his inflation fighting credentials with statements like “Higher for Longer” or “Data Dependent”. Even the release of the Summary of Economic Projections (aka DOT Plot) will support the hawkish message. However, this misses the point, the calendar is quickly rolling, and the Fed needs to address inflation now, perhaps even error on the side of too high.

First, 2024 is an election year, why wait to have a recession only to have the Fed become a political football? Whipping Inflation Now could cause a recession that could cause slack in the employment picture, slower economic activity, and relief for stressed supply chains.

Second, there are charts floating around the internet showing eerie similarities to the 1970’s inflation cycle. Those charts portend the possibility of a resurgence of inflation, to even higher levels. Whipping Inflation Now would address this concern and build confidence inflation won’t return to the same or higher levels.

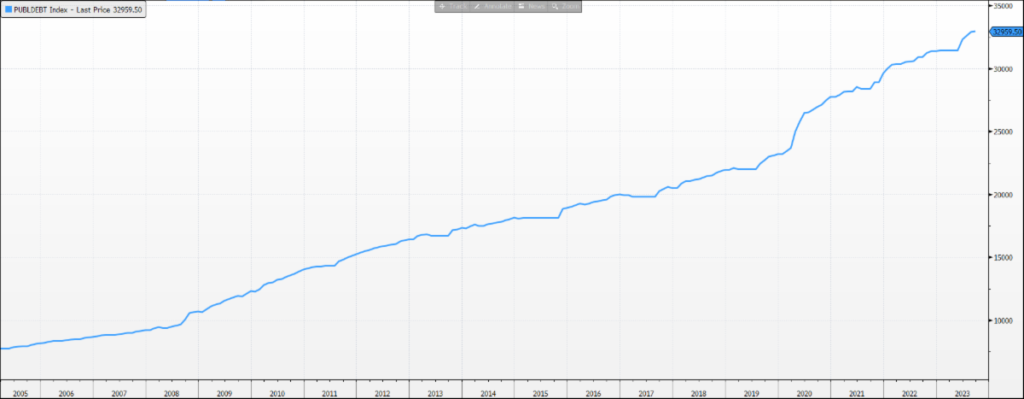

Third, let’s face it, the US Debt outstanding is going to grow rapidly and, with higher interest rates, faster still. Whipping Inflation Now would potentially allow rates to be lower, sooner, and perhaps for longer. That could result in lower refinance rates for the mountain of debt coming due.

I know we have been somewhat dovish in the past, but with the surprising strength of the economy, we believe the FOMC has run out of time and needs to act decisively or risk greater consequences than sticking the soft landing.

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

Next FOMC Decision

September 20, 2023

US Public Debt Since 3-31-2005

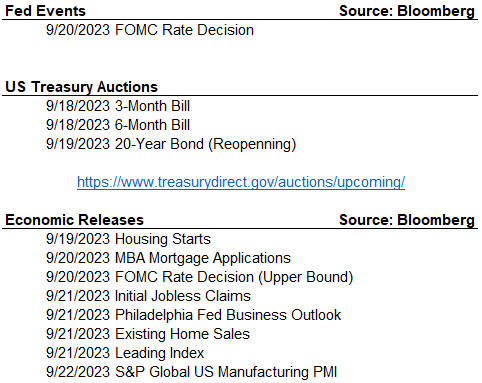

The Week Ahead

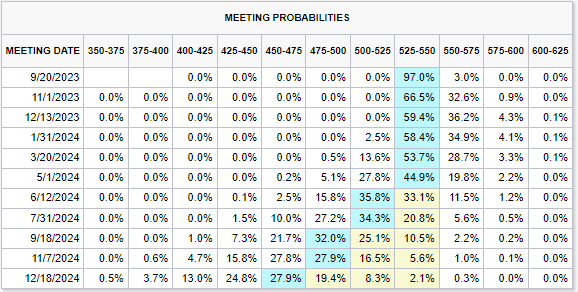

CME Fed Watch Tool

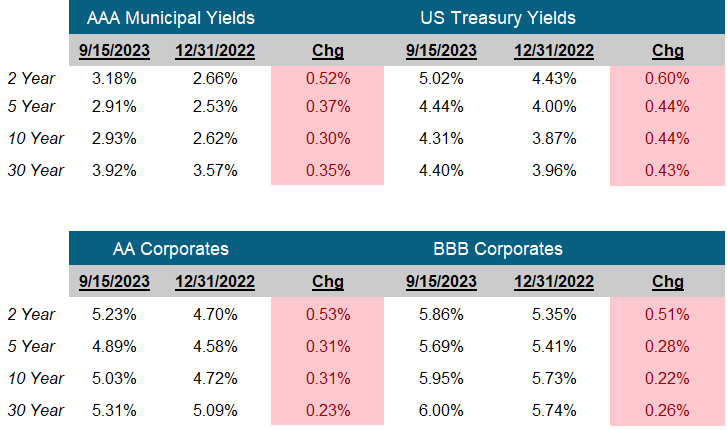

Fixed Income Rates

Click on the above links for more information on important investment and economic concepts.

Contact Genoa Asset Management

William (Kip) Weese

SVP, Intermediary Sales

Northeast & South West

(508) 423-2269

Email Kip

Rick Bell

VP, Intermediary Sales

North Central & North West

(513) 762-3694

Email Rick