October 6, 2023

History doesn’t always repeat, sometimes it doesn’t even rhyme. Take 2023 for instance, just about everyone in the market has been calling for a recession. Since 2021 when the Fed started raising interest rates the theme was not “If” but “When” the recession would start and how bad would it be. Why? When the FOMC raises overnight Fed Funds Rate from 0-0.25% to 5.25-5.50% in 16 months, history, be it repeating or rhyming, tells us expect a recession. More evidence: the yield of the 3-Month US Treasury Bill exceeded the yield on the 10-Year US Treasury Note (The yield curve inverted) November 2022, a recessionary indicator with a solid track record. But it looks like the most anticipated recession of all time isn’t going to happen, anytime soon. And that is why the 10-Year US Treasury yield has risen from an April 6th low of 3.30% to 4.78% today (At 2:00 EST) or 1.48% higher.

History (There we go again), has taught us, if we are going into a recession, own the 10-Year. March 2020, 10-Year US Treasury yield fell (Prices up) 0.49%, November 2008, the 10-Year yield fell 1.00%. Since the recession hasn’t materialized, and at the July meeting the Fed Chairman mentioned they don’t expect a recession this year, investors started unwinding their defensive long bonds and started buying shorter, higher yielding US Treasury Bills.

- The Fed raises rates one or two more times, then similar to 1994, leaves rates high for a period, then cuts slowly as inflation cools and we avoid a recession (I.e. Soft Landing). With short rates higher and concerns a healthy economy forestalls cooler inflation, the 10-Year US Treasury yield could drift higher until the coupons and yields are compelling to the market and yields stabilize.

- The Fed raises rates one or two more times and causes a recession. This could be deflationary, potentially bringing down the 10-Year yield and enabling the Fed to lower the Overnight rate.

- The Fed keeps rates at these levels, the economy continues to grow at a reasonable clip, but inflation remains above the market’s comfort level. This could make the Fed keep the Overnight rate high for an extended time period and potentially cause the 10-Year yield to continue to rise and market volatility increase.

There are other scenarios, we think these most likely given the current economic and market conditions.

Next week we get PPI and CPI, those will give us more insight into which of our scenarios are more likely.

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

Next FOMC Decision

November 1, 2023

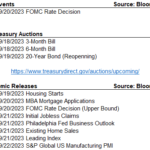

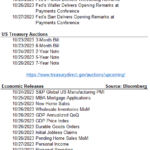

The Week Ahead

CME Fed Watch Tool

Fixed Income Rates

Click on the above links for more information on important investment and economic concepts.