October 20, 2023

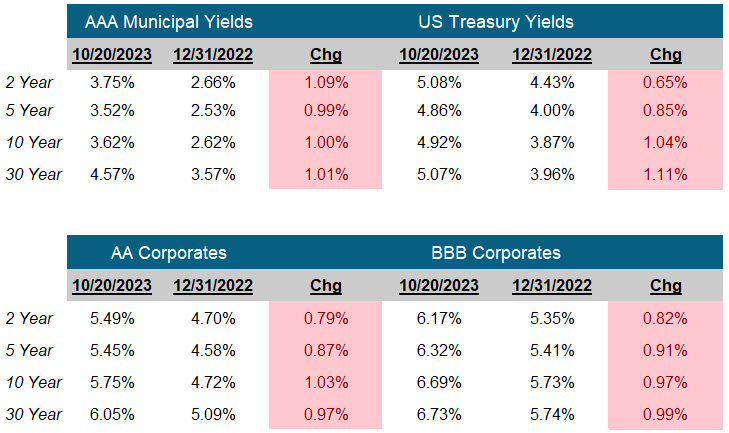

Since the July 26th meeting (The last time the Fed raised the Overnight rate to 5.25-5.50%), the yield on the US Treasury 30-year Bond has risen 1.13%. Other longer dated bonds have followed suit and their yields have climbed. As the yields have climbed, their prices have fallen, creating another tough year for fixed income and the question, has the Fed lost control of the bond market?

In 2023 at it’s low on 4/6/23, the 10-Year Note was yielding 3.31%, but that was the height of the mini-banking crisis and it was looking like the Fed would have to lower the Overnight Fed Funds Rate to support the economy and avert a banking crisis. Alas, the crisis was averted, banks kept lending and rates drifted up. Then at the July 26th FOMC press conference, Chairman Powell announced the Fed staff did not expect a US recession in 2023. What’s more, they seem to be right, second quarter and third quarter GDP growth estimates have improved.. But has the Fed lost control? Perhaps, but we think what’s happening is more in line with their original plan.

At each meeting this year, at almost every speech, the Fed Governors have stated rates will be higher for longer and potentially create a soft landing (aka, no recession). But the market was anticipating a recession, which potentially would wring inflation out of the economy at an accelerated rate. So rates on long bonds were below rates on short bonds & bills (AKA, Inverted). With a soft landing, no quick inflation drop and short bond yield staying higher for longer, the long bonds had to adjust to the new reality and yields rose (Prices dropped).

We acknowledge there has been other contributing factors, more issuance from the US Treasury, the Fed shrinking their balance sheet and others. But we believe economic factors have more to do with broad rate moves of this magnitude than increased supply. (And if the Fed shrinking their balance sheet caused some or all of this, they are not “Out of Control”).

Where does this leave us? Unlike some other investments, the more prices fall on bonds, the more they will return going forward. Today the 10-year US Treasury yields around 4.92%. If you believe the Fed will reach their 2% inflation goal for the next 8-9 years, earning 2.92% over inflation may be very attractive.

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

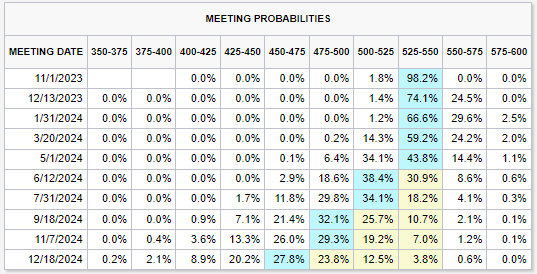

Next FOMC Decision

November 1, 2023

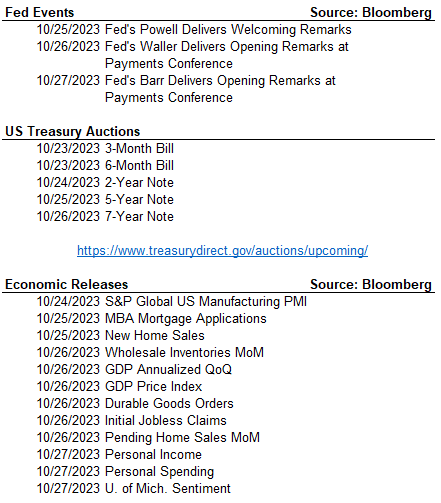

The Week Ahead

CME Fed Watch Tool

Fixed Income Rates

Click on the above links for more information on important investment and economic concepts.