July 1, 2022

We said it, the Treasury Secretary said it, and even the Fed Chair has said it, the Fed is behind inflation and needs to do historic interest rate increases to catch up to inflation. But given the potential of another 75-bps increase, the downturn in some commodities and recent economic releases, it’s appropriate to ask: Is the Fed behind again?

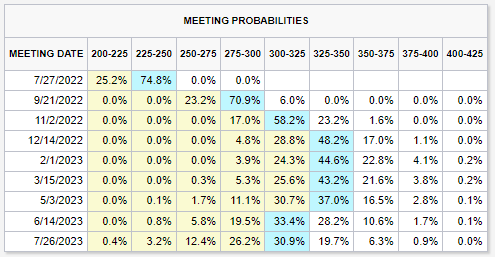

Currently the Overnight Fed Funds rate is 1.5-1.75%. The Fed Chairman strongly hinted at another 75 basis point rise at their July 27th meeting, bringing the rate to 2.25-2.50%. As of this writing, around noon on July 1st, the CME Fed tool projects the rate to top out at 3.25-3.50% (See Below). That is better than the 4% we saw recently, but still another 1.75% higher from today.

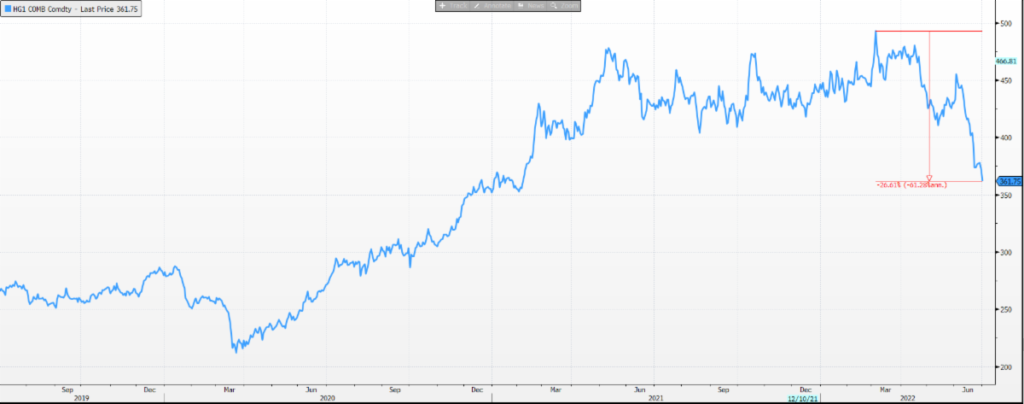

Meanwhile, copper futures are down over 26% from their high on March 7th, and Cotton futures are down 28% from their high on May 16th (See Below). Add to this real personal spending dropped -0.4% in May and the Atlanta GDP Nowcast has 2Q2022 GDP SHRINKING 1.0%. This following a revised 1Q2022 GDP Quarter over Quarter -1.6%.

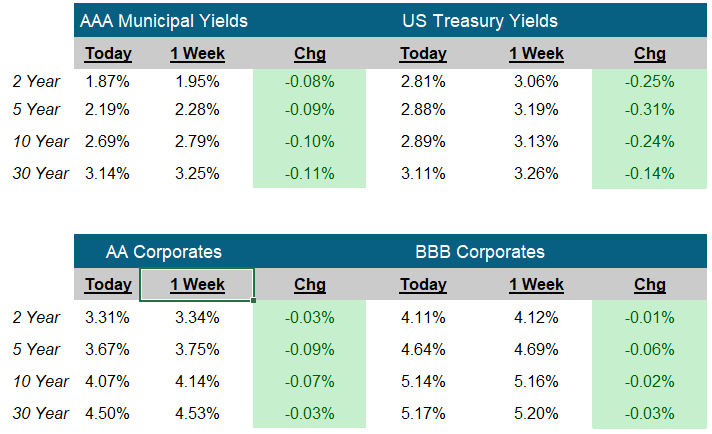

The Fed has artfully used their PR tool to manipulate the bond market to cause a slow down in the economy. Now they need to become data dependent and perhaps slow their pace and consider a lower peak rate. Alas, that seems unlikely, and the prospect of a recession becomes more likely. Thus US Treasuries rallied in a flight to safety, while corporates and municipals traded roughly flat. Some exposure to US Treasuries can certainly help a portfolio through this difficult period. More interesting, start to look into longer dated high quality corporates and municipals. Perhaps we are early on this call, but the yields are attractive, given the risk, and we could potentially see lower rates in response to a recession.

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

Click on the above links for more information on important investment and economic concepts.

CME Fed Watch Tool

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

Copper Generic Future

Click on the above links for more information on important investment and economic concepts.

Cotton Generic Future

Click on the above links for more information on important investment and economic concepts.

Contact Genoa Asset Management

William (Kip) Weese

SVP, Intermediary Sales

Northeast & South West

(508) 423-2269

Email Kip

Art Blackman

VP, Intermediary Sales

Central

(816) 688-8482

Email Art

Rick Bell

VP, Intermediary Sales

North Central & North West

(513) 762-3694

Email Rick

Disclosures

Indexes used for AAA Municipal Yields

2 Year: BVAL Municipal AAA Yield Curve (Callable) 2 Year (Symbol: CAAA02YR BVLI)

5 Year: BVAL Municipal AAA Yield Curve (Callable) 5 Year (Symbol: CAAA04YR BVLI)

10 Year: BVAL Municipal AAA Yield Curve (Callable) 10 Year (Symbol: CAAA10YR BVLI)

30 Year: BVAL Municipal AAA Yield Curve (Callable) 30 Year (Symbol: CAAA30YR BVLI)

Indexes used for US Treasury Yields

2 Year: US Generic Govt 2 Year Yield (Symbol: USGG2YR)

5 Year: US Generic Govt 5 Year Yield (Symbol: USGG5YR)

10 Year: US Generic Govt 10 Year Yield (Symbol: USGG10YR)

30 Year: US Generic Govt 30 Year Yield (Symbol: USGG30YR)

F/m Investments, LLC, doing business as Genoa Asset Management (Genoa), is an investment advisor registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information please visit: https://adviserinfo.sec.gov/ and search our firm name. The opinions expressed herein are those of Genoa and may not come to pass. The material is current as of the date of this presentation and is subject to change at any time, based on market and other conditions. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. The information presented does not involve the rendering of personalized financial, legal or tax advice, but is limited to the dissemination of general information for educational purposes. Please consult financial, legal or tax professionals for specific information regarding your individual situation. This information does not constitute a solicitation or an offer to buy or sell any securities. Although taken from reliable sources, Genoa cannot guarantee the accuracy of the information received from third parties. Charts, diagrams, and graphs, by themselves, cannot be used to make investment decisions. Investing involves risk of loss, including loss of principal. Past performance is no guarantee of future results. An index is a portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Indexes are unmanaged portfolios and investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.