Fixed Income Market Update

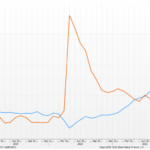

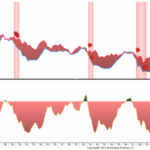

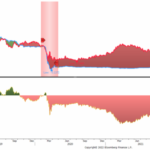

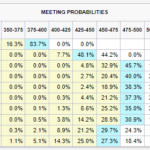

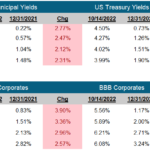

December 16, 2022 With another good CPI report in the hopper, the market continued the relief rally it started when the October CPI report was released. There was plenty of good news on the inflation front, month over month was only up 0.1% and Ex Food and Energy was up only