Investment Strategies

Genoa Asset Management has four individual bond strategies available to investors. The strategies can be customized to meet specific client needs and objectives.

- Rates have Peaked!

November 3, 2023 Okay, maybe we are early (Maybe we are wrong and rates will never be this low again!) but this has been a powerful rally in the long end of the curve. Since October, the 10-year yield had risen 41 basis points to a high of 4.99% and then, failing to break through 5%,

November 3, 2023 Okay, maybe we are early (Maybe we are wrong and rates will never be this low again!) but this has been a powerful rally in the long end of the curve. Since October, the 10-year yield had risen 41 basis points to a high of 4.99% and then, failing to break through 5%, - Fixed Income Market Update

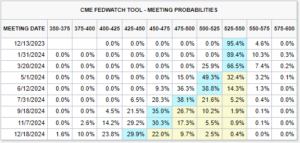

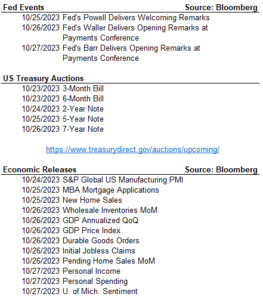

October 20, 2023 Since the July 26th meeting (The last time the Fed raised the Overnight rate to 5.25-5.50%), the yield on the US Treasury 30-year Bond has risen 1.13%. Other longer dated bonds have followed suit and their yields have climbed. As the yields have climbed, their prices have fallen, creating another tough year for fixed

October 20, 2023 Since the July 26th meeting (The last time the Fed raised the Overnight rate to 5.25-5.50%), the yield on the US Treasury 30-year Bond has risen 1.13%. Other longer dated bonds have followed suit and their yields have climbed. As the yields have climbed, their prices have fallen, creating another tough year for fixed - Fixed Income Market Update

October 6, 2023 History doesn’t always repeat, sometimes it doesn’t even rhyme. Take 2023 for instance, just about everyone in the market has been calling for a recession. Since 2021 when the Fed started raising interest rates the theme was not “If” but “When” the recession would start and how bad would it be. Why? When the FOMC

October 6, 2023 History doesn’t always repeat, sometimes it doesn’t even rhyme. Take 2023 for instance, just about everyone in the market has been calling for a recession. Since 2021 when the Fed started raising interest rates the theme was not “If” but “When” the recession would start and how bad would it be. Why? When the FOMC