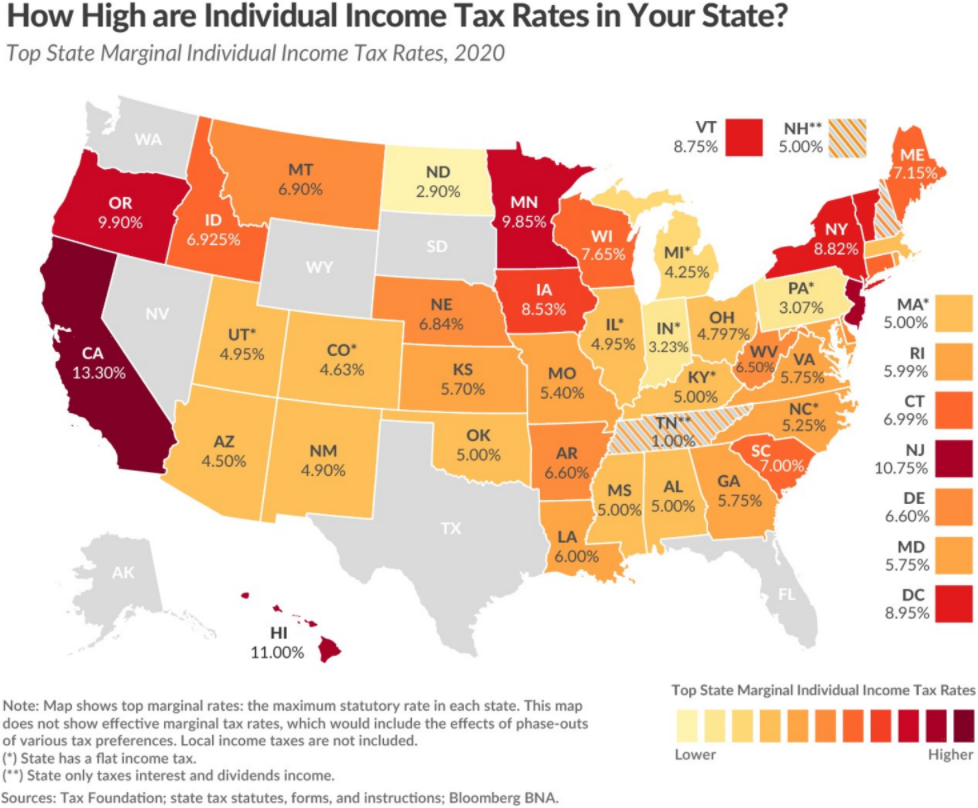

FOR MUNICIPAL BOND INVESTORS, 2020

Municipal securities issued from your state of residence typically provide a level safety and tax-free income that is not found in

equities, treasuries, corporate bonds, or even municipal bonds issued from other states. When considering municipal

investments, investors should first determine if the tax-free income of in-state bond ownership, outweighs the taxable income

offered in out-of-state bonds or other fixed income investments. Genoa Asset Management (F/m Genoa) offers three investment

disciplines to help clients maximize income on an after-tax basis, using the Tax Equivalent Yield (TEY) of the client as our

guide.

F/m Genoa manages client portfolios based on individual investor goals and objectives, offering three actively managed

approaches for the F/m Genoa Intermediate Municipal Bond strategy:

- National – Optimal diversification for clients to maximize yield and appreciation opportunities

- State Specific – Focused approach for clients in high tax states such as California and New York

- State Preference – Provides flexibility of in-state or out-of-state bonds based on after-tax yield and value characteristics

The Benefits of F/m Genoa State Preference Investing

F/m Genoa actively manages municipal portfolios seeking above market yield and opportunity for appreciation. Bonds are considered using value characteristics and after-tax yield calculations between in-state tax-free yields and out-of-state issuers. This process allows us to identify opportunity for increased yield, diversification, and appreciation over portfolios managed to a state specific mandate. Benefits of state preference investing typically include:

- Tax-Free Income from in-state bond ownership

- Increased after-tax income opportunity through higher yielding, out-of-state issuers

- Greater diversification through expanded state and sector selection

- Increased protection against single state or local ratings downgrades

Disclosures

The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. This material is not intended to replace the advice of a qualified tax advisor, attorney, or accountant. Consultation with the appropriate professional should be done before any financial commitments regarding the issues related to the situation are made.

The opinions expressed herein are those of Genoa Asset Management and may not actually come to pass. This information is current as of the date of this material and is subject to change at any time, based on market and other conditions. Although taken from reliable sources, Genoa Asset Management cannot guarantee the accuracy of the information received from third parties.

All investing involves risk including loss of principal. Past performance is no guarantee of future results. Bonds are subject to market and interest rate risk if sold prior to maturity. Municipal bonds are subject to availability, price, and to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rate rise.

The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation by Genoa. The specific securities identified and described above do not represent all of the securities purchased and sold for the portfolio, and it should not be assumed that investment in these types of securities were or will be profitable. There is no assurance that securities discussed in this article have been purchased or remain in the portfolio or that securities sold have not been repurchased. It should not be assumed that any change in investments, discussed in this article have been applied to your account. Please contact your investment adviser to discuss your account in detail.