Evaluating State Preference Portfolios

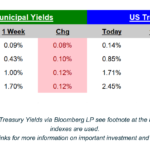

FOR MUNICIPAL BOND INVESTORS, 2020 Municipal securities issued from your state of residence typically provide a level safety and tax-free income that is not found inequities, treasuries, corporate bonds, or even municipal bonds issued from other states. When considering municipalinvestments, investors should first determine if the tax-free income of in-state