Written by Peter Baden, CFA, Chief Investment Officer

As we count the worries on investors’ minds, we can understand the move to reduce risk. Top of the list of worries: A war, worse, a war zone that includes nuclear power plants, in Europe. Next, The decoupling of the Russian and Ukrainian economies (the 11th and 48th ranked economies in the world), in a week’s time. Huge swings in commodities caused the historic actions of canceling trades and closing nickel trading for days. This is on top of the WTI Oil price rising 34.6% from the start of Russia’s invasion of Ukraine on 2/24/2022, only to fall from a high of $123.7 (on 3/8/22) to $108.67 as of this writing (Around 1:00 PM EST 3-11-22). We are also finding out the ripple effects, as companies announce exposures, closures, and write-downs from the War, sanctions, and trades gone wrong.

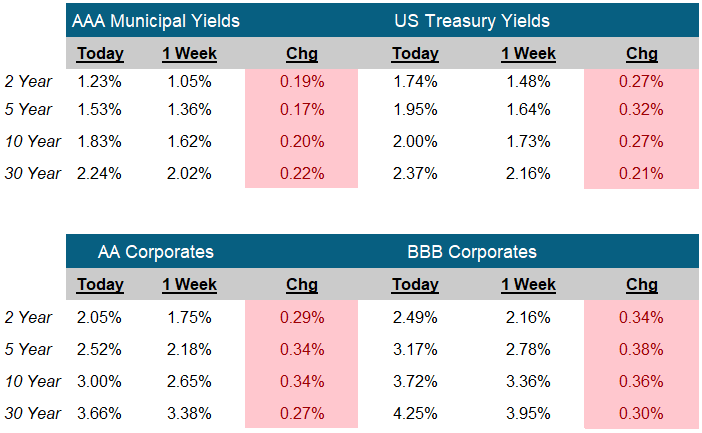

However, the traditional haven, the Ten-Year US Treasury was roughly flat with the yield rising 3.4 basis points since the invasion. The Benchmark bond was responding to its own worries. The Fed Chairman has pledged to raise the Overnight Fed Funds rate at their meeting next week, and the CPI report this morning showed headline Inflation rising 7.9% year over year, core inflation (Ex- Food & Energy) rising 6.4%, each are up from 7.5% and 6.0% readings in January’s report.

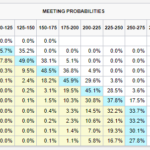

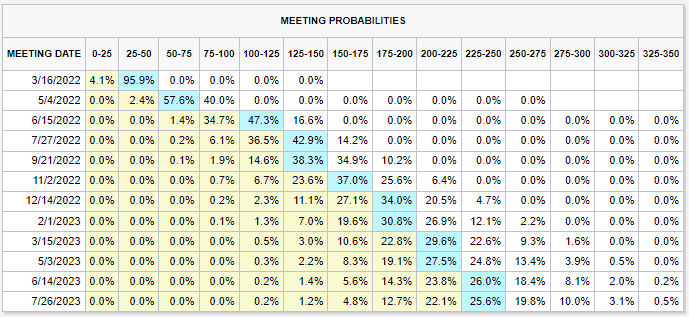

As the market continued to predict seven rate increases in 2022 (See below), fears of stagflation spread in the corporate bond market, causing spreads to widen 10-15 basis points across the curve. Stagflation is of particular concern for companies, as they deal with higher input prices and higher wages with a potential recession on the horizon.

First, our strategies are not invested in Russian or Ukrainian assets or derivatives of those. We are closely watching our large bank holdings for any disclosures, but currently, we don’t expect any credit events in our portfolios from the ripple effects of the war and sanctions. We continue to be conservative with our allocations, holding very high-quality assets in our municipal and quality income strategies and reducing exposure to some of our lower-quality credits in the Opportunistic Income strategy.

Next, as this crisis and economic cycle continues, we are seeing good opportunities in fixed income. With the 2-year US Treasury at 1.74% and a 3 year at 1.92%, that can be a compelling starting point for building or expanding a fixed income portfolio. Pullbacks in municipals and corporates create opportunities to invest assets prudently, at the best spreads we’ve seen in two years.

We continue to be cautious during these trying times. But we recognize that markets seeking liquidity can create opportunities and we stand ready to selectively invest in those opportunities.

CME FedWatch Tool

As of: 03/11/2022

Click on the above links for more information on important investment and economic concepts.

Disclosures

Indexes used for AAA Municipal Yields

2 Year: BVAL Municipal AAA Yield Curve (Callable) 2 Year (Symbol: CAAA02YR BVLI)

5 Year: BVAL Municipal AAA Yield Curve (Callable) 5 Year (Symbol: CAAA04YR BVLI)

10 Year: BVAL Municipal AAA Yield Curve (Callable) 10 Year (Symbol: CAAA10YR BVLI)

30 Year: BVAL Municipal AAA Yield Curve (Callable) 30 Year (Symbol: CAAA30YR BVLI)

Indexes used for US Treasury Yields

2 Year: US Generic Govt 2 Year Yield (Symbol: USGG2YR)

5 Year: US Generic Govt 5 Year Yield (Symbol: USGG5YR)

10 Year: US Generic Govt 10 Year Yield (Symbol: USGG10YR)

30 Year: US Generic Govt 30 Year Yield (Symbol: USGG30YR) F/m Investments, LLC, doing business as Genoa Asset Management (Genoa), is an investment advisor registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information please visit: https://adviserinfo.sec.gov/ and search our firm name. The opinions expressed herein are those of Genoa and may not come to pass. The material is current as of the date of this presentation and is subject to change at any time, based on market and other conditions. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. The information presented does not involve the rendering of personalized financial, legal or tax advice, but is limited to the dissemination of general information for educational purposes. Please consult financial, legal or tax professionals for specific information regarding your individual situation. This information does not constitute a solicitation or an offer to buy or sell any securities. Although taken from reliable sources, Genoa cannot guarantee the accuracy of the information received from third parties. Charts, diagrams, and graphs, by themselves, cannot be used to make investment decisions. Investing involves risk of loss, including loss of principal. Past performance is no guarantee of future results. An index is a portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Indexes are unmanaged portfolios and investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.