Written by Peter Baden, CFA, Chief Investment Officer

Headlines of the Week

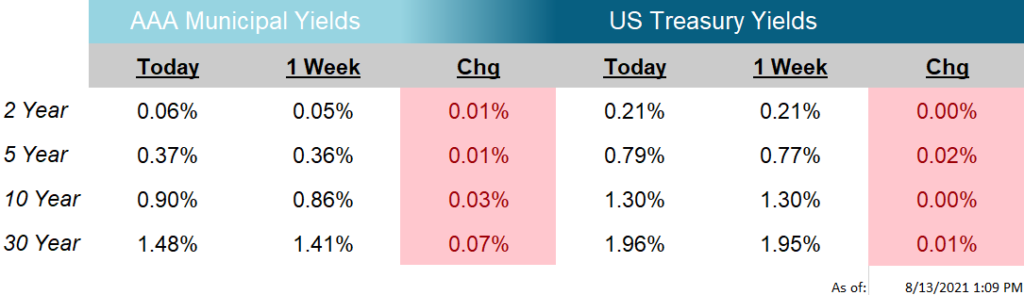

An important week for inflation as CPI and PPI both reported numbers that were high but showing signs of moderating. The US Treasury yield curve was virtually unchanged for the week. With the good jobs report from last week traders pushed the yield on the 10-year US Treasury Note to 1.36%. This continues an uptrend that started from the recent low of 1.17% on August 3rd. However, the CPI news and a successful auction of a new 10-year US Treasury, and weak consumer sentiment brought buyers into the market, causing the yield fall to 1.30%.

The Consumer Price Index (“CPI”) reported Tuesday indicated a moderation of recent overheated trends. The headline CPI YOY was 5.4%, without food and energy the number was 4.3%. However, both numbers were within economist’s expectation and those categories that were driving the outsized gains, moderated. The Producer Price Index (“PPI”), issued Wednesday, estimated Final Demand MoM for July was up 1.0%. this was over expectations of 0.6%, but still being dominated by categories like Automobiles & Auto Parts (+17.4%). Economists took both reports as potential validation of “Transitory” and the market rebounded.

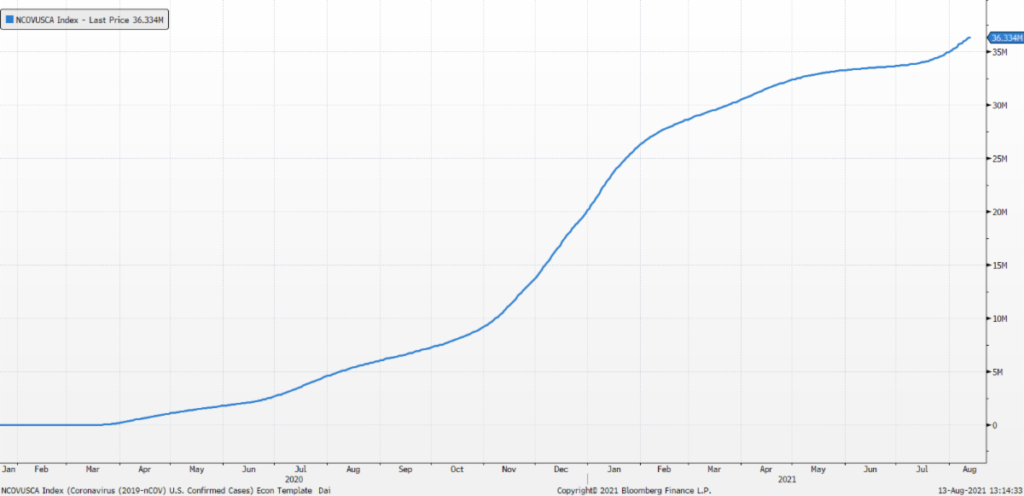

On Friday the University of Michigan Consumer Confidence Survey surprised the markets (81.2 estimated), printing 70.2, The lowest number since November 2011. Taking this as an indicator of COVID concerns and potential economic moderation, bonds rallied. As virus infections and related recommendations, restrictions, and mandates increase the potential economic impact increases. Already companies are reconsidering back to office plans and events are postponing or requiring vaccinations to attend. While a potential negative for growth, a moderation could cool off some of the hotter inflation categories, further supporting “Transitory” theories.

Next week we get readings on manufacturing with the Empire Index, Industrial Production and Capacity Utilization releases. Retail sales and housing numbers are also due for release. Given the indications in the CPI & PPI numbers, we would expect strong manufacturing and moderating retail sales and housing figures.

Chart of the Week

As of: 8/13/2021

Click on the above links for more information on important investment and economic concepts.

Disclosures

Indexes used for AAA Municipal Yields

2 Year: BVAL Municipal AAA Yield Curve (Callable) 2 Year (Symbol: CAAA02YR BVLI)

5 Year: BVAL Municipal AAA Yield Curve (Callable) 5 Year (Symbol: CAAA04YR BVLI)

10 Year: BVAL Municipal AAA Yield Curve (Callable) 10 Year (Symbol: CAAA10YR BVLI)

30 Year: BVAL Municipal AAA Yield Curve (Callable) 30 Year (Symbol: CAAA30YR BVLI)

Indexes used for US Treasury Yields

2 Year: US Generic Govt 2 Year Yield (Symbol: USGG2YR)

5 Year: US Generic Govt 5 Year Yield (Symbol: USGG5YR)

10 Year: US Generic Govt 10 Year Yield (Symbol: USGG10YR)

30 Year: US Generic Govt 30 Year Yield (Symbol: USGG30YR) F/m Investments, LLC, doing business as Genoa Asset Management (Genoa), is an investment advisor registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information please visit: https://adviserinfo.sec.gov/ and search our firm name. The opinions expressed herein are those of Genoa and may not come to pass. The material is current as of the date of this presentation and is subject to change at any time, based on market and other conditions. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. The information presented does not involve the rendering of personalized financial, legal or tax advice, but is limited to the dissemination of general information for educational purposes. Please consult financial, legal or tax professionals for specific information regarding your individual situation. This information does not constitute a solicitation or an offer to buy or sell any securities. Although taken from reliable sources, Genoa cannot guarantee the accuracy of the information received from third parties. Charts, diagrams, and graphs, by themselves, cannot be used to make investment decisions. Investing involves risk of loss, including loss of principal. Past performance is no guarantee of future results. An index is a portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Indexes are unmanaged portfolios and investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.