May 27, 2022

What a difference a week makes. Markets shrugged off the higher rate fears, shook off the recession worries and got down to buying.

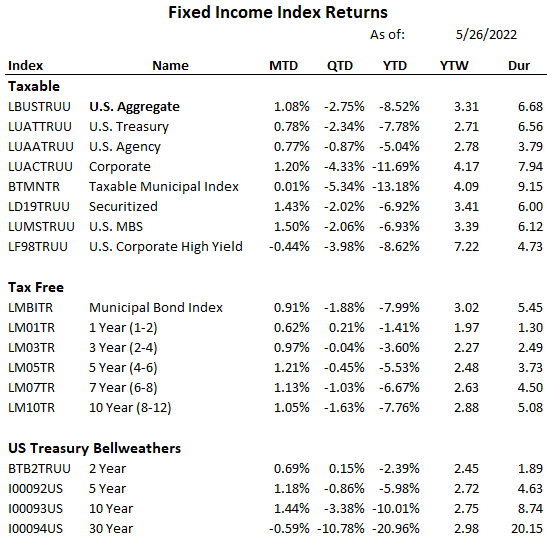

From last Thursday, May 19th through yesterday May 26th, many Bloomberg fixed income indices rallied strongly. Led by the High Yield Index up 2.80%, closely followed by the Municipal Bond index up 2.74%, and investment grade corporate bonds up 1.90%.

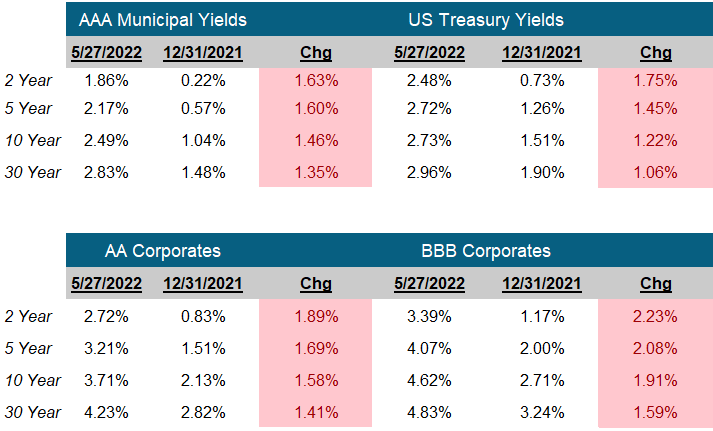

Why the rally? Even as the Fed continues to plan multiple 50 basis point increases to the Overnight rate (And shrink their balance sheet) their biggest tool has already been at work. That tool? The bond market. The Fed has carefully executed a communications plan, including meetings, press conferences, speeches and perhaps a few well placed news articles, that sent a clear message: Expect Higher Rates. And the bond market listened. The Benchmark 10 Year US Treasury which started the year at 1.51%, hit a high on May 6th of 3.131%. With that rise, mortgage rates increased and recent economic releases show housing starts and sales are slowing significantly.

In their earning calls, the management of many companies, particularly retailers, noted a significant slowdown in foot traffic, orders and future growth.

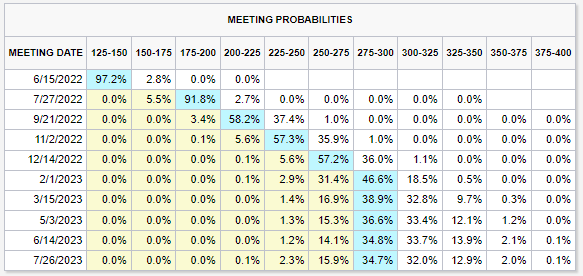

With all this bad news, optimism broke out in the bond market. Growth is not out of control and perhaps the Fed will not need to raise rates as high. Looking at the CME Fed Watch Tool, the options market expects the Fed increases to top out at 2.75%-3%, this is down from 3-3.25% last week. Most importantly, it’s not going up!

Since that recent high, the 10 year yield has dropped, but other sectors have lagged. With such a quick economic reaction to higher rates, the potential of the Fed to avoid a recession may have improved, emboldening investors to take on risk. We are not out of the woods yet, and what we mentioned last week remains favorable now, short dated US Treasuries and high quality municipal bonds remain good values, even after this run.

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

CME Fed Watch Tool

| Source: CME Group 5-27-22 https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html |

| See Disclosures below for index descriptions |

Contact Genoa Asset Management

William (Kip) Weese

SVP, Intermediary Sales

Northeast & South West

(508) 423-2269

Email Kip

Art Blackman

VP, Intermediary Sales

Central

(816) 688-8482

Email Art

Rick Bell

VP, Intermediary Sales

North Central & North West

(513) 762-3694

Email Rick

Disclosures

Indexes used for Fixed Income Returns

U.S. Aggregate – The Bloomberg US Aggregate Bond Index (Symbol: LBUSTRUU)

U.S. Treasury – The Bloomberg US Treasury Index (Symbol: LUATTRUU)

Corporate – The Bloomberg US Corporate Bond Index (Symbol: LUACTRUU)

U.S. Corporate High Yield – The Bloomberg US Corporate High Yield Bond Index (Symbol: LF98TRUU)

Taxable Municipal Index – The Bloomberg Municipal Index Taxable Bond Index (Symbol: BTMNTR)

Tax-Free Muni Index- The Bloomberg Municipal Bond Index (Symbol: LMBITR)

Tax-Free Muni 7-Yr Index – The Bloomberg Municipal Bond 7 Year (6-8) Index (Symbol: LM07TR)

Indexes used for AAA Municipal Yields

2 Year: BVAL Municipal AAA Yield Curve (Callable) 2 Year (Symbol: CAAA02YR BVLI)

5 Year: BVAL Municipal AAA Yield Curve (Callable) 5 Year (Symbol: CAAA04YR BVLI)

10 Year: BVAL Municipal AAA Yield Curve (Callable) 10 Year (Symbol: CAAA10YR BVLI)

30 Year: BVAL Municipal AAA Yield Curve (Callable) 30 Year (Symbol: CAAA30YR BVLI)

Indexes used for US Treasury Yields

2 Year: US Generic Govt 2 Year Yield (Symbol: USGG2YR)

5 Year: US Generic Govt 5 Year Yield (Symbol: USGG5YR)

10 Year: US Generic Govt 10 Year Yield (Symbol: USGG10YR)

30 Year: US Generic Govt 30 Year Yield (Symbol: USGG30YR)

F/m Investments, LLC, doing business as Genoa Asset Management (Genoa), is an investment advisor registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information please visit: https://adviserinfo.sec.gov/ and search our firm name. The opinions expressed herein are those of Genoa and may not come to pass. The material is current as of the date of this presentation and is subject to change at any time, based on market and other conditions. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. The information presented does not involve the rendering of personalized financial, legal or tax advice, but is limited to the dissemination of general information for educational purposes. Please consult financial, legal or tax professionals for specific information regarding your individual situation. This information does not constitute a solicitation or an offer to buy or sell any securities. Although taken from reliable sources, Genoa cannot guarantee the accuracy of the information received from third parties. Charts, diagrams, and graphs, by themselves, cannot be used to make investment decisions. Investing involves risk of loss, including loss of principal. Past performance is no guarantee of future results. An index is a portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Indexes are unmanaged portfolios and investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.