Written by Peter Baden, CFA, Chief Investment Officer

Headlines of the Week

“When demand exceeds supply, the price must go up!”

Or so my Microeconomics 101 professor used to say. Let’s look at our current inflation situation through that lens.

Spring 2020: Pandemic hits, we close all non-essential businesses, everyone stays home. Looking at our equation: Demand Down, Supply still there in some industries (Up in some, i.e. Energy), prices plummet for air travel, car rentals, used cars, gasoline (Energy), etc. Companies respond appropriately to the demand shock and cut supply.

Fast forward, we work from home, develop, test and distribute a vaccine, and come out of our homes with, stimulus checks and all the savings from staying home during the pandemic. Starting summer 2021 consumers hit the economy spending with both fists. But companies are still in recession mode, restraining budgets and hiring (Not to mention working from home!). Going back to our equation: Demand Up, Supply down… Prices Up!

Early on, in the recovery some of the inflation figures were explained as Base Effect or the change from when prices were low during the pandemic. Time has moved forward, and we have passed the base effect window and we still have prices increasing at significant rates. This is one of the reasons the Fed changed their message from patient support to hawkish:

“We’re at a place where unemployment is now very low, historically low, and inflation is well above target, and the economy no longer needs this very highly accommodative stance of policy. And I would expect that this year, 2022, will be a year in which we take steps toward normalization. That will involve raising the federal funds rate. That will involve ending asset purchases in March, and perhaps later this year, depending on the run of things, we would also see ourselves beginning to allow the balance sheet to shrink.”

Fed Chairman Powell in the Q&A portion of his confirmation hearing

Will this continue or get worse? In our last update we mentioned the math associated with the next few CPI ex- Food & Energy releases are going to produce high readings at least through February and March of this year (The % change from last year’s reading to December 2021’s reading produces a 5%+ Year over Year increase). To keep running at these high annual rates, the month over month readings need to average more than 0.44% for 2022 to match the 5.4% December reading. (Just FYI, 0.20% MoM average readings will get us back to around 2.4%).

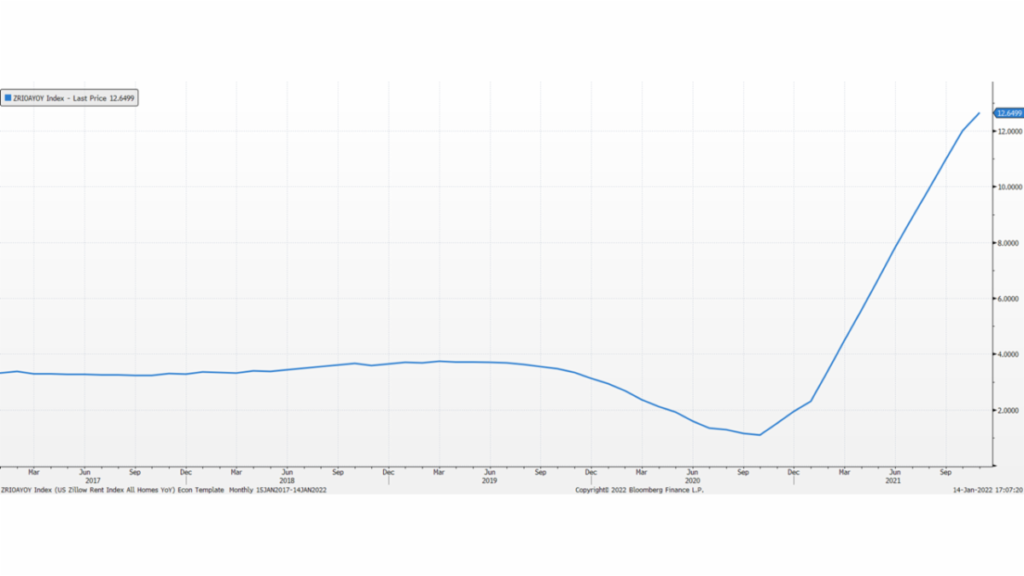

Most economists see this new base effect, some easing of demand and supply increases to mitigate CPI readings around mid-year and finishing 2022 at around 4%. We remain vigilant, specifically watching recent rent surveys as they sometime predict increases in the important housing components of inflation. As shown in the US Zillow Rent Index – All Homes graph below, rents are increasing. There is usually a lag effect for this to be incorporated into CPI of twelve months but this trend could worry Fed policy makers.

US Zillow Rent Index – All Homes

As of: 11/30/2021

Click on the above links for more information on important investment and economic concepts.

Disclosures

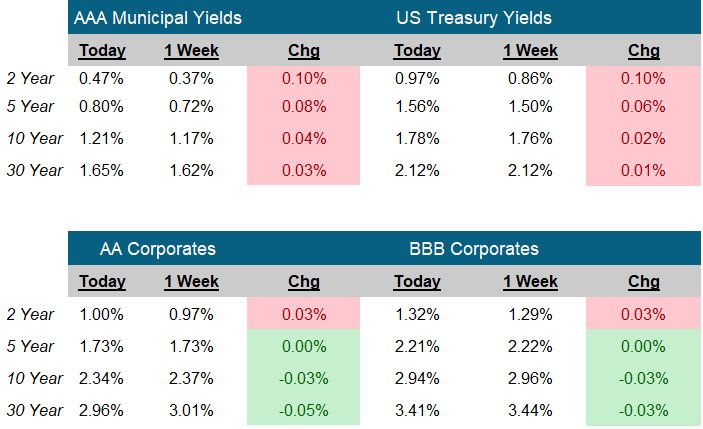

Indexes used for AAA Municipal Yields

2 Year: BVAL Municipal AAA Yield Curve (Callable) 2 Year (Symbol: CAAA02YR BVLI)

5 Year: BVAL Municipal AAA Yield Curve (Callable) 5 Year (Symbol: CAAA04YR BVLI)

10 Year: BVAL Municipal AAA Yield Curve (Callable) 10 Year (Symbol: CAAA10YR BVLI)

30 Year: BVAL Municipal AAA Yield Curve (Callable) 30 Year (Symbol: CAAA30YR BVLI)

Indexes used for US Treasury Yields

2 Year: US Generic Govt 2 Year Yield (Symbol: USGG2YR)

5 Year: US Generic Govt 5 Year Yield (Symbol: USGG5YR)

10 Year: US Generic Govt 10 Year Yield (Symbol: USGG10YR)

30 Year: US Generic Govt 30 Year Yield (Symbol: USGG30YR) F/m Investments, LLC, doing business as Genoa Asset Management (Genoa), is an investment advisor registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information please visit: https://adviserinfo.sec.gov/ and search our firm name. The opinions expressed herein are those of Genoa and may not come to pass. The material is current as of the date of this presentation and is subject to change at any time, based on market and other conditions. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. The information presented does not involve the rendering of personalized financial, legal or tax advice, but is limited to the dissemination of general information for educational purposes. Please consult financial, legal or tax professionals for specific information regarding your individual situation. This information does not constitute a solicitation or an offer to buy or sell any securities. Although taken from reliable sources, Genoa cannot guarantee the accuracy of the information received from third parties. Charts, diagrams, and graphs, by themselves, cannot be used to make investment decisions. Investing involves risk of loss, including loss of principal. Past performance is no guarantee of future results. An index is a portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Indexes are unmanaged portfolios and investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.