Fixed Income Market Update

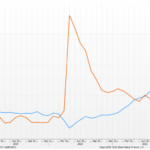

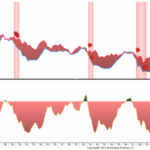

March 10, 2023 Yesterday SVB Financial (SVB) parent company of Silicon Valley Bank announced they are doing a significant capital raise to cover losses from their portfolio of… Mortgage backed and Treasury Bonds. SVB stock dropped 60%, bonds and preferred issues were down significantly and Moody’s announced a downgrade of the