Fixed Income Market Update

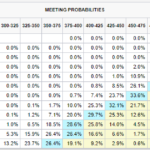

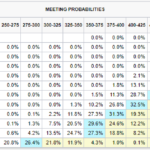

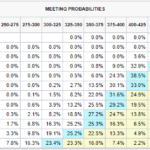

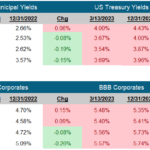

June 22, 2023 The FOMC held their meeting last week. From that we have a press release, press conference various speeches and congressional testimony. The overriding theme has been: Higher rates for longer (Note, we are back to Higher). But didn’t the FOMC just pause? If they are so worried to get inflation down